Dollar General Crashes Most On Record After Management Warns Of "Financially Constrained Core Customer"

Tyler Durden

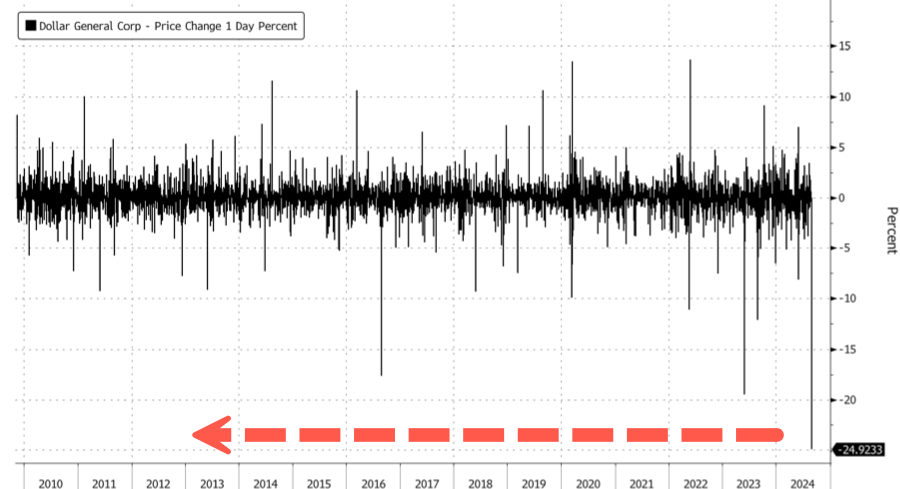

Dollar General shares plummeted by as much as 26% as the US cash trading session got underway, marking the steepest intraday decline ever. Dollar General shares plummeted by as much as 26% as the US cash trading session got underway, marking the steepest intraday decline ever.

Shares crashed to early 2018 levels.

Dismal earnings sparked the record drop in DG's share price.

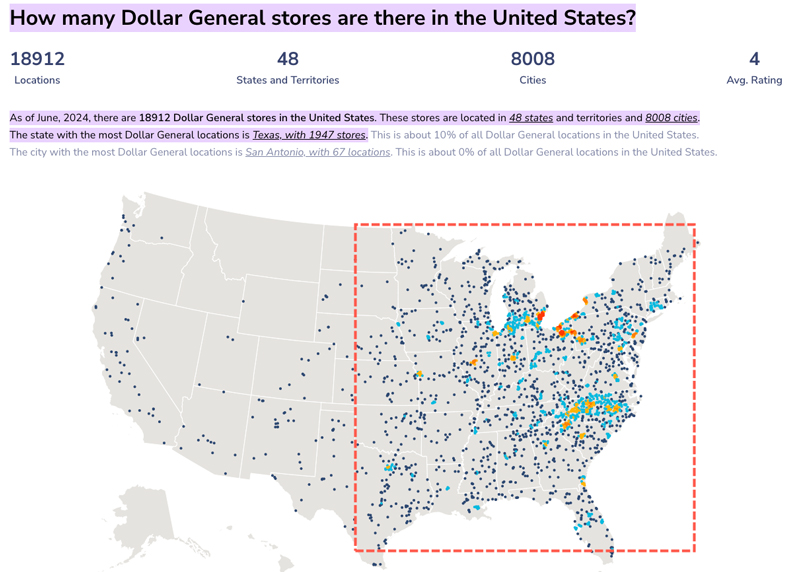

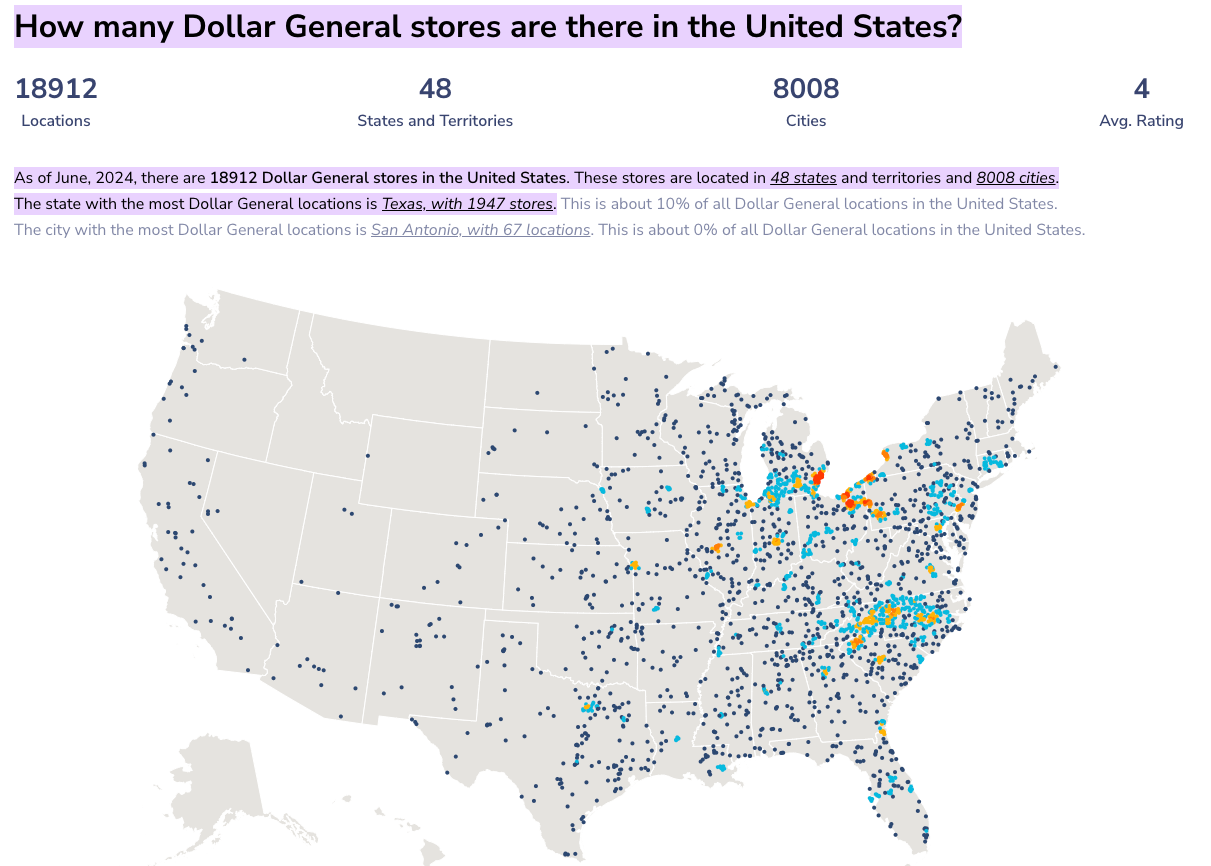

As previously mentioned, DG's management noted that core customers "feel financially constrained." By examining store locations, we can identify the states where these customers are most pressured.

For the political strategists out there, this might give some understanding, perhaps in swing states, where customers are being financially crushed the most by Bidenomics. Given the map, it appears to be the entire eastern half of the US.

* * *

Shares of Dollar General Corp. crashed 23.5% to hit levels not seen since 2018 in premarket trading in New York following a disappointing second-quarter earnings report. The nation's largest discount retailer missed Wall Street's profit and sales expectations and slashed its full-year forecast. The retailer warned that its core customers "feel financially constrained."

The discount retailer, which has nearly 19,000 locations in 48 states and 8,000 cities, reported adjusted earnings per share of $1.70 for the second quarter, missing the average estimate of analysts tracked by Bloomberg of $1.79. Revenue came in at $10.21 billion, below estimates of $10.37 billion, but still up 4.2% year-over-year. Same-store sales rose .5%, missing the 2.07% estimate.

Here's a snapshot of second-quarter earnings (courtesy of Bloomberg):

- EPS $1.70 vs. $2.13 y/y, estimate $1.79

- Net sales $10.21 billion, +4.2% y/y, estimate $10.37 billion

- Comparable sales +0.5% vs. -0.1% y/y, estimate +2.07%

- Gross margin 30% vs. 31.1% y/y, estimate 30.3%

- SG&A as percentage of revenue 24.6% vs. 24% y/y, estimate 24.4%

- Operating profit $550.0 million, -21% y/y, estimate $587.5 million

DG lowered its full-year outlook for sales and profit. The company slashed its guidance ranges for EPS to $5.50 to $6.20 from $6.80 to $7.55 and for same-store sales growth to 1% to 1.6% from 2% to 2.7%. Bloomberg consensus was around 2.47%.

More color on the full-year outlook (courtesy of Bloomberg):

- Sees comparable sales +1% to +1.6%, saw +2% to +2.7%, estimate +2.47% (Bloomberg Consensus)

- Sees EPS $5.50 to $6.20, saw about $6.80 to $7.55, estimate $7.11

- Sees net sales +4.7% to +5.3%, saw +6% to +6.7%

- Sees effective tax rate 23%, saw 22.5% to 23.5%

- Still sees capital expenditure $1.3 billion to $1.4 billion, estimate $1.39 billion

CEO Todd Vasos acknowledged consumers are being pressured in today's environment of elevated inflation and high interest rates:

"While we believe the softer sales trends are partially attributable to a core customer who feels financially constrained, we know the importance of controlling what we can control. With the evolving retail and consumer landscape in mind, we are taking decisive action to further enhance our value and convenience offering, as well as the in-store experience for our associates and customers."

Shares crashed 23.5% in premarket trading to the midpoint of the $94 handle, the lowest level since early 2018.

For analysts at consumer desks, DG's nearly 19,000 stores across the US offer valuable insight into the financial health of low- to mid-tier consumers.

DG's dismal report reminds us that the consumer downturn theme is still in play and should worsen in the months ahead. Hence, the Fed's interest rate-cutting cycle may begin as early as Sept. 18. The Fed rarely cuts into good times. The Biden-Harris team's disastrous Bidenomics policies have financially crushed an entire generation of consumers.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|