Stocks Will Have One Last Hurrah After Jackson Hole

Simon White

Federal Reserve Chair Jay Powell’s speech at Jackson Hole this week promises to give stocks a boost. But it’s likely to be short lived as the liquidity outlook soon worsens. Federal Reserve Chair Jay Powell’s speech at Jackson Hole this week promises to give stocks a boost. But it’s likely to be short lived as the liquidity outlook soon worsens.

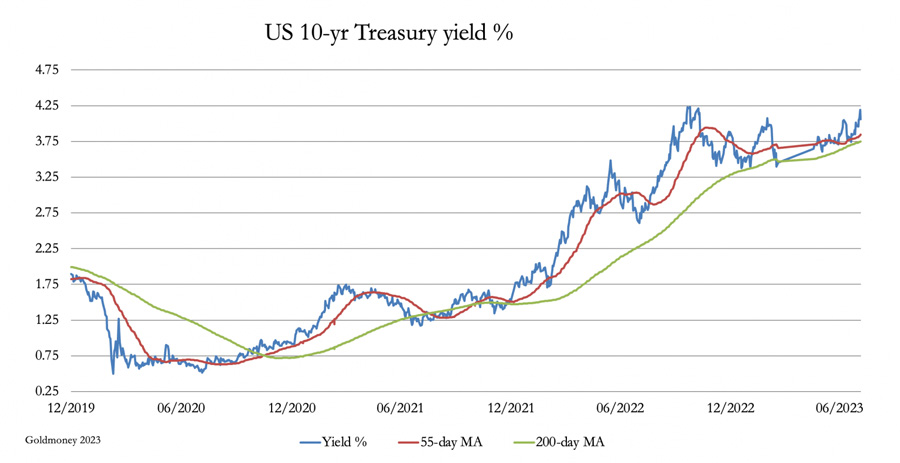

After months of rising almost uninterruptedly, stocks finally hit resistance as longer-term real yields rose to a 15-year high. The main driver though - a belief that the Fed will up its estimate of the neutral rate at Jackson Hole - is likely to come unstuck, prompting a relief rally in stocks.

But this is a trade rather than an investment, as real-yield curve dynamics point to less supportive liquidity conditions on their way soon, turning what was a tailwind for stocks and other risk assets into a headwind.

What is the US? Or Russia? Or the dollar, or Christianity, or Apple? These are not glib questions. They are what the historian Yuval Noah Harari refers to as “intra-subjective beliefs,” concepts that have meaning and utility because many people believe in them.

To the list we could add the neutral rate of interest. Normally such an abstraction would not have a real market impact. But given the market’s recent focus on it, it appears to have had just that.

Longer-term real yields began to rise in late July. It’s not a fait accompli, however, that this was driven by the neutral rate. The yield on a TIPS bond is the “actual” real yield + the TIPS liquidity premium. Often a rise in the real yield is driven by a rise in the liquidity premium as TIPS are sold.

But in these situations, breakevens typically fall too. The fact that they have remained steady shows that the rise in real yields was principally driven by the “actual” long-term real yield, i.e. by the neutral rate.

But that leaves the real yield open to disappointment. Powell is expected to up the Fed’s estimate of neutral at his Jackson Hole speech on Friday. Even if he does (although it’s unlikely he would want to unnecessarily tie the Fed down), there is a lot already in the real yield’s level, leaving it prone to reversing (after peaking at 2%, 10y real rates are now at 1.84%, still about 36 bps above where they were a few weeks ago).

The initial reaction would likely be a boost for stocks and other risk assets. Stocks started to sell off when 10y real yields began to rise in late July; a fall is likely to bring some relief to the equity market.

But the real information content comes from looking at the real-yield curve and its relationship with excess liquidity and the dollar. I discussed the mechanics fully here, but the TikTok version is that a flatter real-yield curve has led to a weaker dollar, and that has been the main driver of this year’s boost to global excess liquidity: the difference between real global money growth and economic growth, denominated in USD.

The flattening real-yield curve has thus signaled positive conditions for real assets through rising excess liquidity.

We saw this in reverse over the last few weeks: 10y real yields rose, the real-yield curve steepened, the dollar rallied and stocks sold off.

We now have a clearer idea of exactly why a fall in longer-term reals should trigger a rally in stocks. But it also tells us that any rally is fated not to last long. That’s because it is very unusual for the real-yield curve to flatten as 10-year real yields drop, i.e. a bull-flattening.

The chart below shows the 2s10s real-yield curve color-coded for different curve moves (over rolling six-month periods). Bull-flattenings only occur about 7% of the time (going back to 2004).

Much more common are bear-flattenings (brown color in the chart above), when two-year real yields rise more than 10-year reals. But two-year reals are already nudging 20-year highs (excepting their GFC spike). It will be difficult for them to push much higher, especially with the Fed near-done or done raising rates, and the likelihood inflation starts rising again.

Also a negative influence for short-term real yields would be the Fed raising its inflation target. Whether it eventually happens or not (and there is a lot to discuss on the topic), it is something we are likely to hear increasingly more about.

Either way, the real-yield curve is poised to soon begin steepening again (chiming with expectations the nominal curve also continues to steepen), meaning what is currently a tailwind for risk assets in buoyant excess liquidity is soon set to turn.

To recap, a rise in expectations of the neutral rate likely drove the real yield higher. Stocks are poised for a relief rally as these expectations are disappointed, but it’s likely to be short-lived as the real-yield curve starts to re-steepen, pointing to a fall in excess liquidity.

This might seem a lot of convolution when one could simply point to the rise in nominal yields over the last month being the culprit for the stock selloff. But well over half of the time (59%, going back to 1962) when yields are up over the previous month, stocks are up too.

Such a rule-of-thumb is thus very misleading. The truth, as Oscar Wilde said, is rarely pure and never simple.

Simon White is a macro strategist at Bloomberg, and co-founder of Variant Perception, a widely respected investment-advisory firm. He has advised some of the largest and most successful hedge funds, banks and financial institutions in the world on the economic outlook and their investment strategies.

www.zerohedge.com

|