Send this article to a friend:

June

28

2024

Send this article to a friend: June |

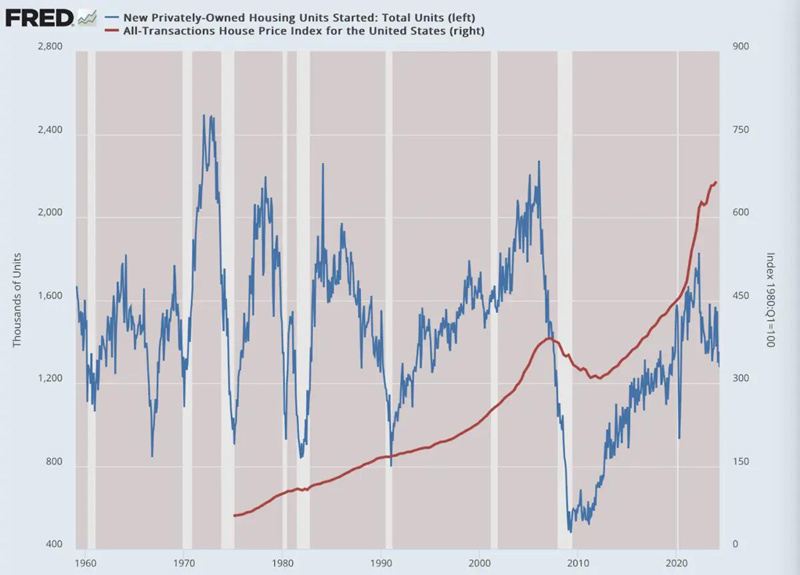

Another Blow To The Housing Market

If you cannot think of buying a new house right now, it’s going to be harder in the future. If you are hoping to sell, it’s a great time to do so, but then you have a problem: You need to live somewhere. That’s why so many people today are frozen in place, unable to even consider moving for a better job because it means giving up a locked-in low rate for a sky-high new rate in the midst of a price explosion. That’s if you can even find a house on the market. Both housing starts and new building permits fell off the cliff in May (down by 5.5 percent in starts and 3.8 in permits month over month), and the previous month’s data was revised downward. This means we’ve faced three months of falling trends in both areas that constitute all new supply for housing. There are no signs of improvement. That’s the supply side. The demand side pushes in the opposite direction with well-heeled buyers in constant bidding wars with cash buyers for anything that comes on the market. The big institutions are in the market in a way never before seen, with a familiar pattern of house-flipping done by major investment houses. The single most useful tool in economics theory is the idea of supply and demand as the basis of price. The model was described as early as the 16th century and became conventional analytics only in the 19th century. The socialists of the time never accepted supply and demand, oddly enough. In fact, supply and demand is all we need to understand why all this is happening: intense demand on the buyers’ side, and restriction on the supply side. We are at lower levels of new construction in the post-lockdown period. The result is far beyond anything we ever saw in 2008. If that was a bubble, there are no words for what is going on right now.  (Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker) The demand side of the market is facing an issue we’ve never seen before. The inflation in insurance premiums is making it unaffordable for many people, with anecdotal reports of doubling and tripling prices. With a mortgage, you absolutely must carry insurance as a matter of contract, same as with car insurance. If you can’t afford the insurance, you must sell to a cash buyer who doesn’t have to have it. Why precisely is this happening? Of course, it’s a perfect opportunity for major media to cite this as an effect of “climate change,” but there is actually no evidence I’ve seen that this is true. The actual and full culprit here is really the depreciation of the currency in terms of goods and services, plus the rising costs of all repairs of anything and everything. Insurance premiums are upstream of all the costs associated with rebuilding, repair, cleanup, reconstruction, and all the materials associated with that. The companies aren’t being greedy; they are simply responding to the metrics reported by their own actuaries. They ask the question “What is the risk that this house could go up in flames or otherwise face weather-related damage relative to the expense associated with fixing it after?” They are coming up with crazy figures on the cost side of some disaster, which is due to worker shortages, skills deprecation, and inflation of all materials. In addition, with the increase in housing prices, replacement costs rise in tandem, so, of course, insurance prices go up, too. In other words, the insurance premiums are merely reporting on the metrics downstream from events against which they are insuring. The numbers are shocking because all official data is massively underreporting inflation. Insurance premiums are merely reflecting the inflationary reality under the surface of the rah-rah media reports. Something similar is happening to car insurance. Electric vehicles are hugely expensive to repair, and it’s the same with hybrids. But the entire market for car repairs faced a blow with lockdowns, from which it hasn’t recovered. Supply chains became a snarled-up mess with lots of bankruptcies and disruptions, and the labor market for repair experienced an exodus of workers who moved on to other industries or simply left town.  This aerial picture shows homes near the Chesapeake Bay in Centreville, Md., on March 4, 2024. (Jim Watson/AFP via Getty Images) Get this. Do you know what isn’t included in the consumer price index (CPI)? Car and home insurance. They are simply not part of the measured basket. The CPI also excludes home prices, replacing them with a proxy called owners’ equivalent rent, which is not a reflection of reality. It also uses a crazy metric to assess health insurance such that an increase can be rendered as a decrease. In addition, the CPI can’t measure added fees and shrinkflation. The result is that the CPI has become pure fantasy at this point. Anything happening in the housing market, from interest to insurance to prices themselves, is simply not included. Once we do include them, you can generate numbers that are easily in the double digits. Including house prices alone (excluded as of 1983) takes current numbers from 3.5 percent to 6 percent. Throwing in interest and insurance and more gets us very easily to double digits for fully two years. The more you think about the statistical razzle-dazzle here, the more you gain a picture of the worst three years of inflation since the Civil and Revolutionary Wars. Try as we might, there is no firm number we can put on it. This is what accounts for the sinking expectations of consumers and producers, and the down-in-the-mouth attitudes of everyone toward their economic and financial plight. This whole picture is worsened by the extremely spooky refusal of official and media culture to report on the realities with any degree of honesty or sophistication. I’ve written now for two years that my intuition is that we never left the recession of March 2020. Recessions are usually measured as a decline for two successive quarters of inflation-adjusted output as captured by the gross domestic product (GDP). There are two major problems. The GDP numbers are disguised by the inclusion of government spending and debt as contributors to growth. But making matters even worse, the inflation adjustment to that big number uses what’s called personal consumption expenditures, which underestimate inflation even more than the CPI. Once you add in a realistic inflation number, you end up with no positive returns on the GDP for the past three years. In other words, we very well could be in the midst of an unreported inflationary depression. Actually, correct that: a global inflationary depression. Wouldn’t that be something if such a thing were happening right now and it never entered the headlines? That’s what statistical trickery will do. The mess of the housing market today is only the most conspicuous indicator of this. The beneficiaries are Invitation Homes, American Homes 4 Rent, and Yieldstreet, directly, and BlackRock and Fidelity indirectly. Does this sound a bit like “You will own nothing and be happy?” You’ve got that right. After 2008, we were supposed to learn the lesson of the dangers of housing bubbles. That is now a joke. No one learned anything. The Fed got busy in 2008 blowing up the housing bubble again and now the mess of 2008 looks like a mere practice run for where we are today. We have simply never seen anything like this. It effectively spells the end of the postwar American dream of middle-class home ownership. There are solutions to this, but it’s not yet part of the political discussion. There are no signs that the trouble is going to end anytime soon.

|

Send this article to a friend:

|

|

|