In normal times, the best investing strategy is to ignore FOMO (fear of missing out) and instead accumulate great stocks slowly via low-ball bids, dollar cost averaging, and put writing. A variation of this advice appears at the end of every recommendation in this newsletter.

But there’s another take on (especially) the gold miners, which is that they’re beginning an epic run destined to produce life-changing gains for those who 1) choose the right companies and 2) board the train early (i.e., now). Commodities analyst Marin Katusa just posted a compelling case for this strategy. Here’s an excerpt:

Dear Reader,

At 211 °F, water is merely hot.

Steaming as it simmers quietly, on the cusp of transformation.

Yet, at 212 °F, a mere one-degree difference ushers in an intense transformation.

Water begins to boil, releasing powerful steam capable of powering a freight train.

It’s that one single degree that makes all the difference, a tiny shift that marks a powerful change.

There are many reasons we are at that one degree uptick transition moment in the gold market… we could be at the cusp of a historic and monumental rally.

Ignore this at your peril because right now…

Gold isn’t just climbing—it’s boiling over.

And it’s those who act, not those who hesitate, who reap the rewards.

Now if you’re ready to take the heat, read on.

There’s no Going Back, Gold is Hitting the Boiling Point

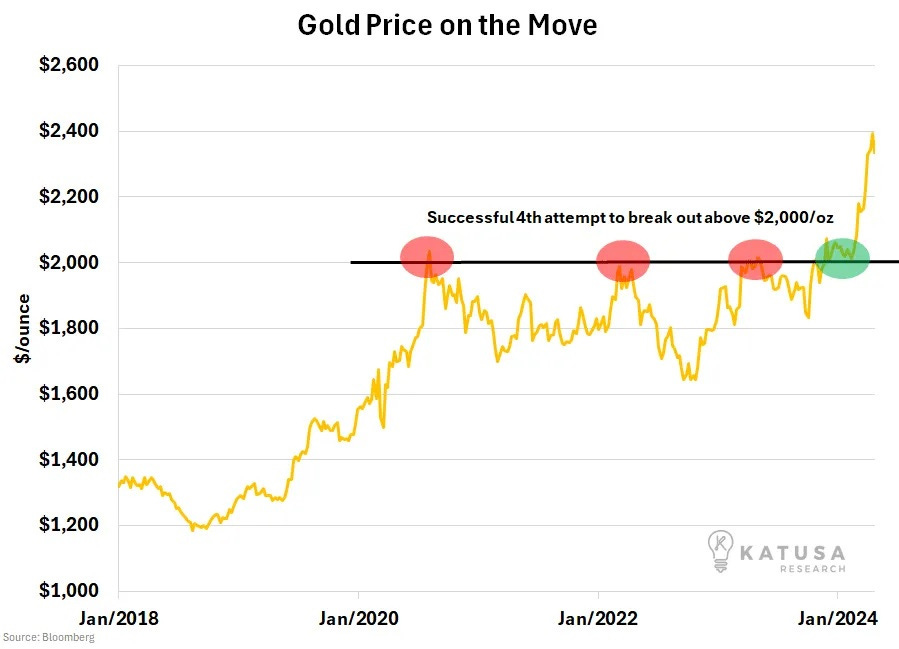

Gold just hit $2,400 per ounce, marking yet another record high for the metal this year. It is up nearly 15% year to date, and since January 2023, it is up 30%.

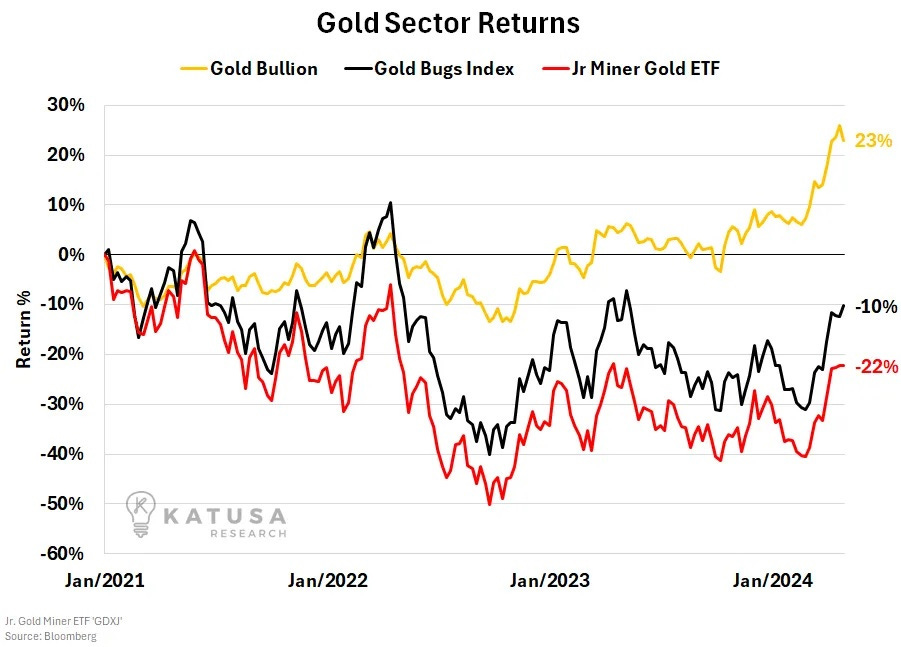

Yet contrary to gold, companies with leveraged exposure to gold have not fared nearly as well.

You’d think gold producers, developers, and explorers should all be up at least as much as gold.

But as you’ll see in the chart below, neither the NYSE Gold Bugs Index nor the Van Eck Gold Miners ETF have come close to gold bullion’s returns.

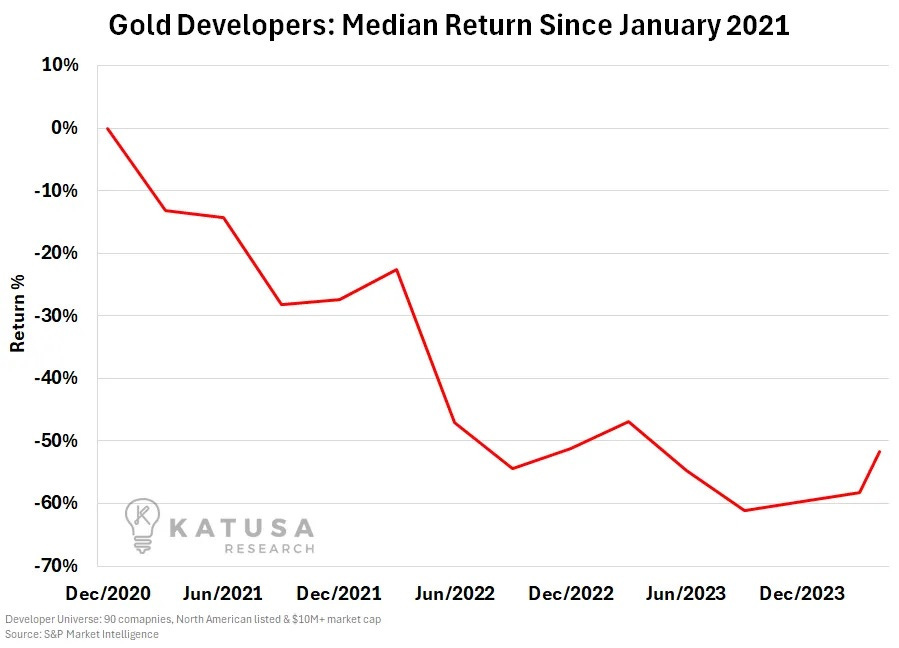

Companies operating in the gold development space have fared even tougher sledding.

It’s Time to Get Selective and “Picky”

It really is a bewildering time for gold investors.

You would think record highs in gold would lead to immediate records for share prices but that has not been the case so far.

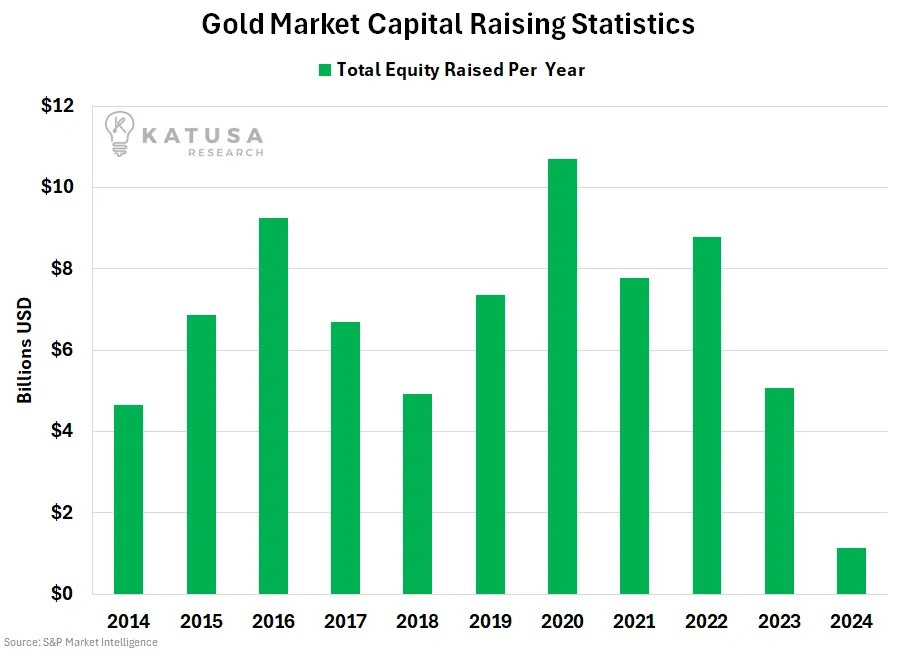

Compounding the issue for the sector, over the past few years, capital-raising activities by gold companies have steadily declined.

Below is a chart that shows the equity raised through financings by gold companies since 2014.

Weak share prices and reduced access to capital create an opportunity for the bold investor… or company.

Beneath the headlines of share price underperformance and capital raising, the market fundamentals are functioning well.

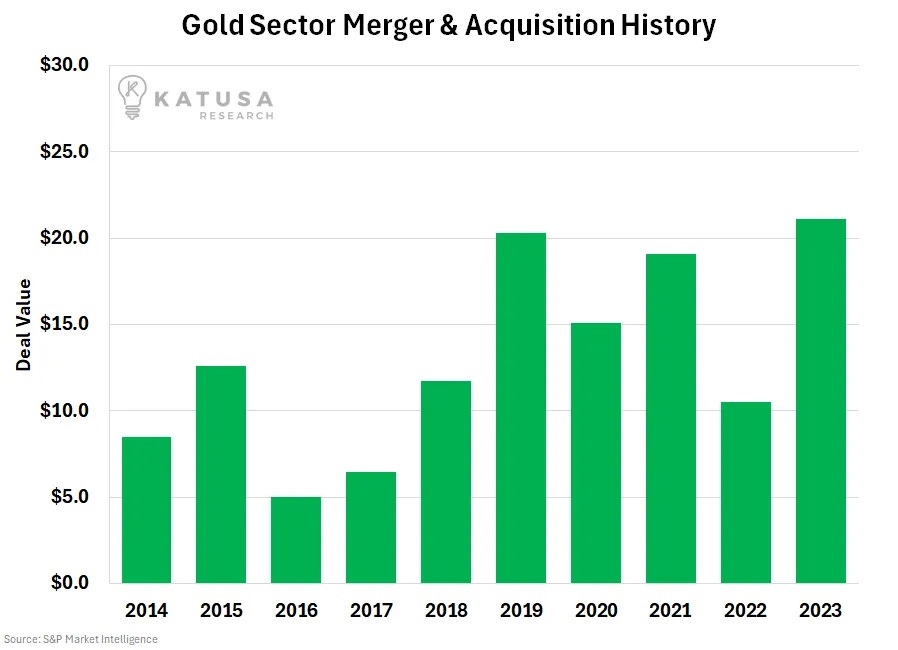

One way to look at this is through mergers and acquisitions activity in the sector.

In dark times, there’s no cash flow generated or ability to raise capital to do deals, we saw this in 2016 and 2017.

Today is much different.

Gold M&A is Heating Up…

Even though financings and share prices are down, players in the sector continue to gobble each other up.

Over the past few years, the gold market has seen big growth in the transaction value of mergers and acquisitions.

But even with the recent frenzy of M&A activity, valuations for companies are still low, especially for those in the development stage.

For now.

Especially if you don’t own any gold stocks backed by people who know M&A or how to make lucrative win-win deals…

And how to acquire valuable assets that nobody’s heard about (or with the know-how and access).

It’s hard not to be excited by what certainly looks like a generational commodities bull market. But market timing is hard to the point of impossibility for most people. So definitely keep buying the highest quality gold, silver, uranium, oil, and copper stocks. But do it on dips (of which there will be many). If this is a legit bull market, we’ll be riding it for years.