|

More Good News On The Silver Deficit

John Rubino

Supply down, demand up. Thanks, China! Supply down, demand up. Thanks, China!

Ah, the silver story. It just keeps getting better. Here’s an update from the Silver Institute:

Industrial Silver Demand Sets Record

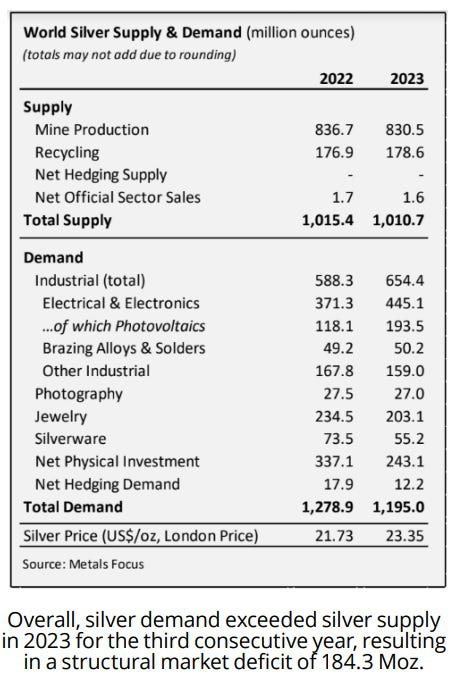

Record use of silver in industrial applications set a new high in 2023 at 654.4 million ounces (Moz). Ongoing structural gains from green economy applications underpinned these advances as they did in 2022. Higher than expected photovoltaic (PV) capacity additions and faster adoption of new-generation solar cells raised global electrical and electronics demand by a substantial 20 percent. At the same time, other green-related applications, including power grid construction and automotive electrification, also contributed to the gains.

Silver Demand

Total silver demand in 2023 declined 7 percent to 1,195 Moz in 2023, but outstripped supply for the third consecutive year, resulting in a structural market deficit of 184.3 Moz, however. The price-sensitive physical investment, jewelry, and silverware sectors mainly contributed to last year’s lower demand. In sharp contrast, industrial demand hit another record high, led by the electrical and electronics sector, which grew 20 percent to 445.1 Moz last year. This gain reflects silver’s essential and growing use in PV, which recorded a new high of 193.5 Moz last year, increasing by a massive 64 percent over 2022’s figure of 118.1 Moz.

Underpinning these overall gains was the limited scale of thrifting and substitution, as silver remains irreplaceable in many applications.

Chinese silver industrial demand rose by a remarkable 44 percent to 261.2 Moz, primarily due to growth for green applications, chiefly PV. Last year, China’s rapid expansion of PV production accounted for over 90 percent of global panel shipments. Industrial demand in the United States stood at 128.1 Moz, essentially flat over 2022, while Japan’s industrial offtake was also basically unchanged at 98.0 Moz.

Silver Supply

Global silver mine production fell by 1 percent to 830.5 Moz in 2023. Output was significantly affected by the four-month suspension of operations at Newmont’s Peñasquito mine in Mexico following a labor strike. Mexico’s silver output fell by 5 percent to 202.2 Moz.

Important Points

- Today’s mines produce around 830 million ounces of silver annually, while silver demand is 184 million ounces higher. Given the many problems now facing miners, supply is unlikely to rise appreciably in the coming decade.

- Most of the current deficit is due to solar panels, which is the fastest-growing line in the above table and shows no sign of slowing down. Here’s the projected solar demand growth in the US (which is a distant second in size to China):

Silver’s trajectory remains highly favorable. So keep stacking, and consider the silver ETFs highlighted in this newsletter’s portfolios. This is going to work out nicely.

Subscribe to John Rubino's Substack

Thousands of paid subscribers

Survive and Thrive in the Coming Crisis

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) andÊThe Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

rubino.substack.com

|