Send this article to a friend:

April

22

2023

Send this article to a friend: April |

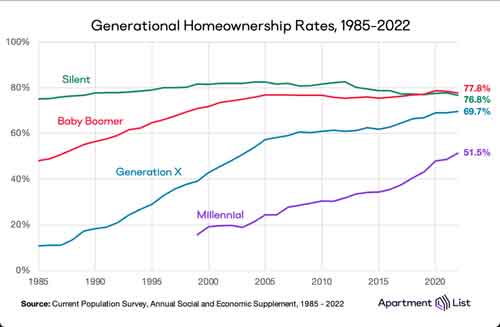

Millennials Are Slowest Generation To Hit 50% Homeownership, Fear That Fed Is Making A Permanent Renter Class (Fed Policy Errors Strike Again!)

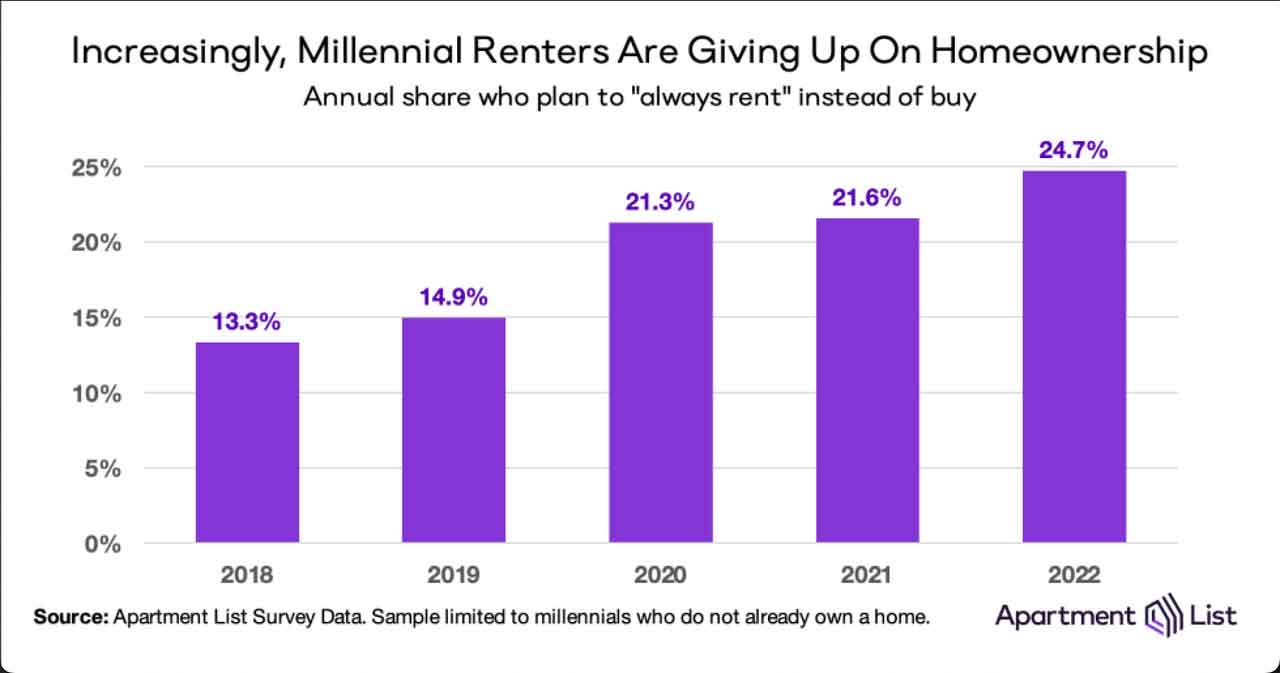

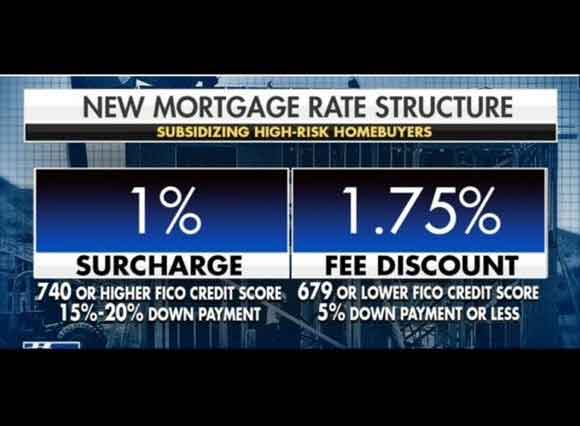

For example, the massive almost hysterical overreaction of The Fed under Powell (following Yellen’s Reign of Error) to the Covid economic shutdowns resulted in a massive surge in M2 Money growth [green line]. The result? REAL US housing prices soared while REAL averge hourly wage growth was negative for 24 straight months. THAT is the Fed error induced housing policy blunder. But it did increase the US homeownership rate (blue line).  A massive spike in REAL home prices coupled with 24 straight months of negative REAL hourly wages is hitting millenials hard. In fact, millennials are the slowest generation to hit 50% homeownership rate.  In fact, according to Apartment List, millenial rents are giving up on homeownership.  As a result, The Federal government is making yet another idiotic policy error to cope with the effects of Fed money printing. Subsidizing high-risk homebuyers — at the cost of those with good credit.

Jeder nach seinen Fähigkeiten, jedem nach seinen Bedürfnissen (German for “From each according to his ability, to each according to his needs” – Karl Marx. Remember, the US got into trouble in the early 2000s by pushing homeownership and lowering credit standards for lower income households. It was a Clinton-era policy error called “The National Homeownership Strategy: Partners in the American Dream.” There is a video of then HUD Secretary Andrew Cuomo (yes, THAT Andrew Cuomo) saying that the US should risk higher mortgage defaults so low income households could buy a home … then default. Frankly, Washington DC should get out of the housing business altogether. But nooooo. They are now going to make things even worse. Janet Yellen: The most terrifying person in the world!

|

Send this article to a friend:

|

|

|