Send this article to a friend:

March

27

2023

Send this article to a friend: March |

Is This the Tipping Point?

At an actual party, it’s easy to know when it’s time to say your goodbyes. The hosts turn the music off, start looking at their watches and taking away the snacks. In this metaphorical party, though, how do you know when it’s over? Analysts describe the end as a “Minsky Moment,” defined as:

The two most important words there, I think, are “sudden” and “inevitably.” Experts from JP Morgan think the moment is now:

In the past week, investors have contended with several U.S. bank bailouts, market volatility, the collapse of Credit Suisse and the European Central Bank’s 50 basis-point rate hike. The Fed’s decision to increase rates this week will likely provide yet another concern to Kolanovic and his team. Obviously, this isn’t the first time that a Minsky Moment has happened in the U.S. The U.S. has experienced a handful in the past, some of which you’ll remember if there’s enough gray in your hair:

Since 2008, we’ve talked a lot about a “Lehman moment” – referring to the collapse of white-shoe Wall Street investment bank Lehman Brothers, which notably wasn’t bailed out by the Fed or the Treasury Department. It’s the same thing. It doesn’t matter what we call that tipping point, that event or that day when everyone finally recognizes the party’s really over, tries to leave at the same time and gets jammed at the exits. When you read the context above, take note of the common elements in both prior Minsky Moments; debt and bubbles. It looks as though both of those elements are making a return appearance right now. All Minsky Moments have one thing in common I discussed the “everything bubble” and its consequences in May of last year. (It didn’t really take a crystal ball to see it coming, though – all you need is a grasp of how financial markets work and a little history). Like those before and, presumably, future Minsky Moments, the one thing they have in common is debt:

(If you’re a regular reader, you know all this already.) When ultra-easy monetary policy makes credit and borrowing overabundant, a bubble forms. Instead of being incentivized to save money, the combination of inflation and rising asset prices sends money flooding into increasingly speculative gambles. When rates go up, like they are right now, all the debt generated to fuel that asset price bubble becomes an anchor that drags economic activity down. Again, if you pay attention, you already know all this – and you aren’t alone. There’s been no lack of reporting on Wall Street’s mismanaged debt. Comparisons to 2008 only point out jus how much bigger the bubble is this time around:

When the bubble pops, asset prices generally decline – and that puts a heavy dent in our savings. To make matters worse, failing banks often escape the consequences of their disastrous decisions – thanks to government bailouts. If you think about it, banks are basically the only corporations in the U.S. that simply aren’t allowed to fail. Banks have the federal government convinced that they’re so important that the entire nation is bound by a suicide pact. We can’t afford to let banks fail, the feds will tell us – so we’re going to save them – and you’re going to pay for it. That’s right. To add insult to injury, we, you and I, the taxpayers, ultimately pay the bill. And not in just one way, but in several!

The problem with identifying any Minsky Moment in real time is, well, you can’t. Even the sharpest and most seasoned Wall Street veteran can only identify the moment a bubble stops deflating and starts popping in hindsight. Since we can’t know the future, what can we learn from the past? No one’s going to bail us out In the end, we all have to look out for ourselves. If you’ve been persisting in the delusion that financial analysts can help, allow me to present you with two facts:

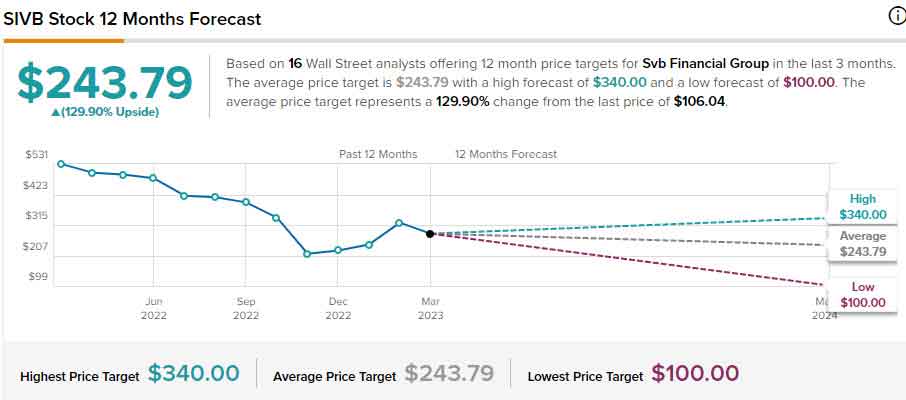

via TipRanks Let me reiterate: no one but you is looking out for your best interests. During times of crisis, whether it’s the next Minsky Moment, bank failure or whatever other black swan event manifests, there’s a coordinated rush to safe haven assets. As the Wall Street proverb goes, no one wants to try to catch a falling knife. Among safe haven assets, physical precious metals (especially gold and silver) are the gold standard safe haven, as they have been for centuries. Demand is closely tied to price – because no one can print more gold bullion… Is this a Minsky Moment or not? I don’t know, but what I can tell you is the price of physical gold has risen 8.34% since March 7th. I strongly recommend you take a minute and educate yourself on the benefits of diversifying with safe haven assets like physical gold and silver (the information is free, and there’s no obligation). Here at Birch Gold, we sincerely believe that education is your best defense against bubbles and panics, market volatility and Federal Reserve shenanigans. You can learn more here.

|

Send this article to a friend:

|

|

|