Send this article to a friend:

March

04

2023

Send this article to a friend: March |

Is the Golden Age Of 2% Inflation Over?

With that in mind, let’s look into the past to see what a longer period of inflation looks like. The best place to start in the U.S. is to take a brief look at an extraordinarily long period of inflation that took place from the 1970s to the early 1980s. We don’t have to examine every detail, which would take hours, but this summary will suffice:

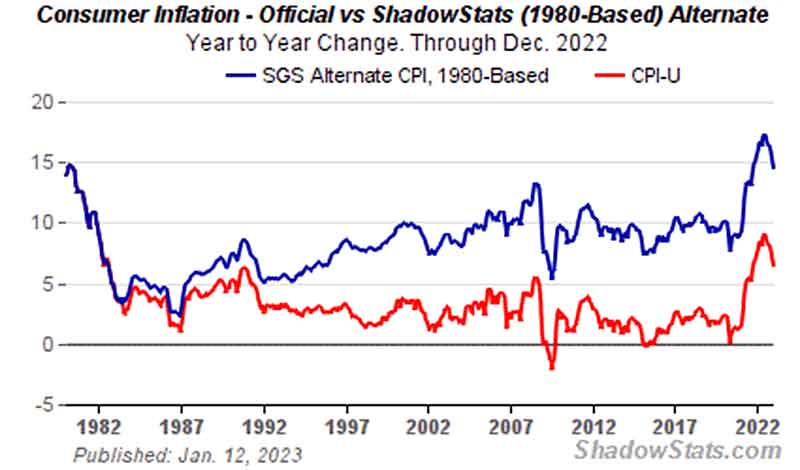

It took an extremely dramatic move by then-Chairman Paul Volcker to raise rates high enough (nearly 20%) to get inflation to cool, an action that ultimately triggered a recession. Fortunately, Volcker’s efforts finally tamed inflation, and set the U.S. economy up for massive growth. You can see the tail end of the historic result of this inflationary period on the chart below. Official inflation is reported on the red line, and the blue line represents how it was reported in the early 1980s. But you can also see approximately when the Fed’s methodology for reporting “official” inflation changed (marked by where the two lines diverge):  via ShadowStats Looking at both lines on the graph above in 2023, you might be thinking that the years-long trend of red-hot consumer price inflation (CPI) will begin easing back to normal in short order. It’s a reasonable assumption. There is a trend that’s pointing in the right direction. And that’s where the next part of this story begins… High inflation is always stickier than we hopeUnfortunately, there is still a long way to go before any substantial price relief will materialize, particularly for those getting by on fixed incomes:

I’ve said it before and I’ll say it again – the Fed started way too slowly, after wasting months trying to gaslight us into believing inflation would go away by itself. That didn’t work. When they finally, grudgingly accepted that they’d have to do something, they took a “baby steps” approach that seemed far more concerned with letting Wall Street down easy than with the price of food and fuel. In the words of Quincy Krosby, chief global strategist for LPL Financial, “They have a ways to go, it took [the Federal Reserve] a long time to acknowledge that inflation was stickier than they initially assessed.” When you start late and move slowly, it takes you a whole lot longer to reach your destination. The problem is, the entire American economy is along for the ride. Moving slowly is bad enough – but as long as it’s in the right direction, at least it’s progress. Anti-inflation efforts shift gear – into reverse Revisions often fly under the radar, underreported in mainstream media – especially when revisions turn good news into bad news. Case in point: A couple of weeks ago CPI was revised upward for October, November, and December 2022. Powell’s “disinflation” was just a daydream, dispelled by accurate data. That’s bad enough. But the journey to 2% inflation has taken another wrong turn… The personal consumption expenditures (PCE) price index has been revised upwards too. PCE can be thought of like a “direct price hike” on goods and services:

What a mess. Wolf Richter summarized just how big an issue this is:

Now, what do we do in the face of a stubborn inflationary trend? An awful lot of people are making ends meet by piling up debt:

When prices go up faster than income, you either cut your costs or borrow money. Recently, Americans have mostly chosen the “borrow money” route – perhaps they actually believed all the “transitory” hand-waving? Maybe they’re hoping that prices will come down soon? Never forget: hope is not a plan. Any time your financial future is resting on nothing but hope, you’re very likely to find yourself in trouble rather soon. Before long, people will hit the limits on their credit cards. Then, they’ll be stuck paying both higher prices and credit card bills. That’s a tight spot to be in and, regardless of whether we experience a full-blown national credit crisis, millions of American families will struggle through their very own financial mess. All thanks to the tax no one voted for, and everybody pays. So let me ask: should we wait for the Fed to put us back on track, and hope they can get the job done soon? Or should we take matters into our own hands? Taking control of your own financial future While you’re saving for the future and planning for retirement, consider a wide variety of inflation-resistant investments to insulate your savings from the corrosive effects of inflation. We don’t know what prices will be like next month, let alone a decade or two down the road – so it’s comforting to know you can plan for future expenses in today’s dollars. Stubborn inflation is just one of many reasons that prudent families consider both physical gold and silver to be vital safe havens in times of high inflation. We can’t count on the Fed to figure things out. Jerome Powell does not have my best interests in mind. Call me a cynic if you want, but I don’t have a lot of faith or hope in the Federal Reserve. They’ve mishandled the into two and a half epic financial crises since the turn of the century. That’s not exactly an enviable track record… Is it smart to diversify your savings with assets the Fed can’t inflate away? Should we take control of our financial futures out of the hands of unelected bureaucrats? That’s a decision you must make for yourself. If you do want to reclaim some of your financial sovereignty with physical precious metals, Birch Gold is here to help.

|

Send this article to a friend:

|

|

|