Send this article to a friend:

February

27

2025

Send this article to a friend: February |

Weirdest Housing Bubble Ever

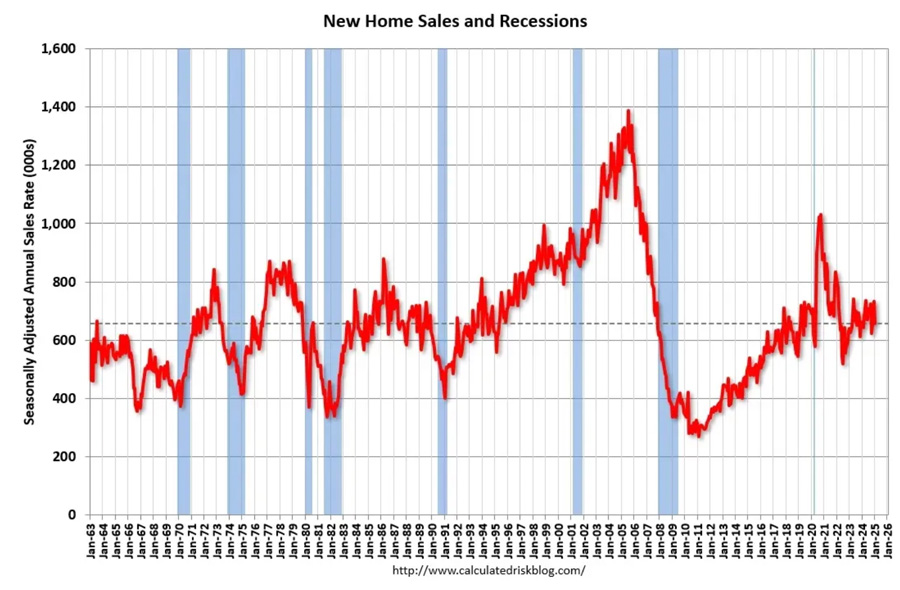

It's not clear how this resolves Real estate is cyclical, which means it has its booms and busts, each of which differs slightly from the last. But today’s US housing market is so outside the norm that its strangeness has become the story’s main theme. Consider: Numerically speaking, housing used to be driven by young families buying starter houses. But today, the median age of homebuyers is 56. That’s up from 31 as recently as 1981: Homebuilding used to be a major part of the real estate market (and the overall economy), but current new home sales are at 1960s levels despite the US population rising by 100+ million in the subsequent six decades.

And even this anemic market requires ever-increasing government intervention. From a recent X post:

To sum up, the US housing market is dominated by aging, increasingly indebted people who are buying fewer houses and missing more payments. And Now It’s Rolling OverA growing number of houses listed at current prices aren’t selling, and are being pulled off the market (i.e., delisted). The monthly delisting rate is now moving into 2007 housing bust territory.

Homebuilders, meanwhile, are sitting on vast amounts of raw land, so they have to keep building even in the face of a weakening market. As a result, the supply of new homes for sale is spiking. Note the widening “under construction” category. Even hot markets like Texas and Florida are being flooded with inventory. So How Does This Resolve?A normal housing boom ends with a bust in which prices are cut and mortgage interest rates fall sufficiently to make houses affordable again. But this is not a regular market, because young families don’t earn enough to get anywhere near today’s real estate. So something more extreme has to happen. Not only do home prices and/or interest rates have to fall hard, but incomes on the lower rungs of the economic ladder have to rise dramatically. And it’s not clear how those two things can happen simultaneously. Like I said, very weird. Charles Hugh Smith just posted a good overview of this subject. Here’s an excerpt.

Read the rest of Charles’ post here. Subscribe to John Rubino's SubstackThousands of paid subscribers

Survive and Thrive in the Coming Crisis

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) and The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|