Send this article to a friend:

February

08

2025

Send this article to a friend: February |

Congress Slowly Realizing Promised Tax Cuts Are Unaffordable – What’s Next?

There are two ways that political parties (at least in the U.S.) attempt to boost the economy. Well, really there are hundreds of ways, but they fall into one of just two tactics. Either letting people keep more of their money (lowering compliance costs, cutting taxes) or “wealth transfers” (handouts). And they tend to be pushed along party lines, for the most part (though, both parties, at times, have used some of both). The first way that politicians think can boost the economy is for the government to pump money into the economy. Democrats are the ones who publicly advocate for that because they’re open about being Keynesians, believing that deficits don’t matter and that national debt is a point of pride. That the solution to higher prices is to give out even more money to pay those higher prices… Sadly, we’ve seen the impact of that kind of government spending is. We’ve seen it from Bidenomics over the last few years and still see significantly higher prices on everything every time we go grocery shopping. The other way to boost the economy is usually associated with the GOP, and it has to do with letting people and businesses have more control of their lives again. The typical talking points for this option are decreasing government regulation, which allows businesses more freedom and less administrative costs, and reducing taxes, which allows people to keep more of their money in their own pockets to use the way that they want. I think it’s clear which of the two I personally approve of! But I digress – and this is an economics column, not a political soapbox. If you’ll remember, one of the major accomplishments of Donald Trump’s first term as President was to put into place a number of tax cuts. In fact, they’re usually referred to, collectively, as “the Trump tax cuts.” Those tax cuts probably boosted the economy during his first term, at least before covid, the pandemic panic and global lockdowns crushed economic activity in 2020. Many people understandably like those tax cuts. Businesses sure do! And they’re one of the central planks of Trump’s platform. Even so… Trump’s tax cuts may be an endangered speciesThat’s right. After leading the Republicans to a sweeping victory in the 2024 election, Republicans in Congress are debating sunsetting the Trump tax cuts! Justin Green with Axios writes:

What kind of time frame are they considering instead of making them permanent (which is what Trump wants)?

Is five years better than taking them away completely? Sure. Here’s the problem. The federal government needs more revenue. And with a debt mountain of $36,451,000,000,000 to pay off, that’s growing over a trillion dollars every year? The government cannot afford to slash its own income! Let’s step back for a moment and ask the question behind this situation: Why is Congress worried about Trump’s tax cuts?That’s the (multi) billion dollar question, isn’t it? And the answer has a lot to do with dealing with the fallout of the last four years of Keynesianism without restraint that we call Bidenomics. Mychael Schnell and Emily Brooks with The Hill write:

Let’s be real here. The primary problem may not be that Trump’s plans necessarily cost that much (though, it’s possible that some are expensive). Frankly, a huge part of the issue (maybe the entirety of the expense issue) is that there is still the lingering impact of government expenses, including servicing the Federal debt, left over from terrible economic policies from the last administration that was passed on to Trump when he took office again last month. That’s quite a bit to take in, I know. Some of you may still have a follow-up question which is… What happens if Trump’s tax cuts expire sooner? That’s a question worth asking because smart people will start planning for the future keeping the answer to that question in mind. The answer is this: only extending those tax cuts for five years is going to cause huge economic problems for the next administration in the White House, no matter which party they’re with. Tax increases (which, let’s be honest, is what ending a tax cut really is: a tax increase) historically cause a decrease in consumer spending and a decrease in overall business activity. In plain words: Increasing tax rates slows down the economy. If you take money away from people, they can’t spend it. Consumer spending makes up about two-thirds of total economic activity! So, when consumer spending declines, the broad economy experiences all sorts of problems. Job losses, business failures, bankruptcies… But that is the very real possibility that we’re being told could happen five years from now if Republicans in Congress don’t extend Trump’s tax cuts. Stuck between a rock and a hard place Here’s the problem: Cutting taxes doesn’t solve the revenue problem. The Department of External Revenue, though? Could THAT fund the federal government? I did the math (based on 2024 numbers):

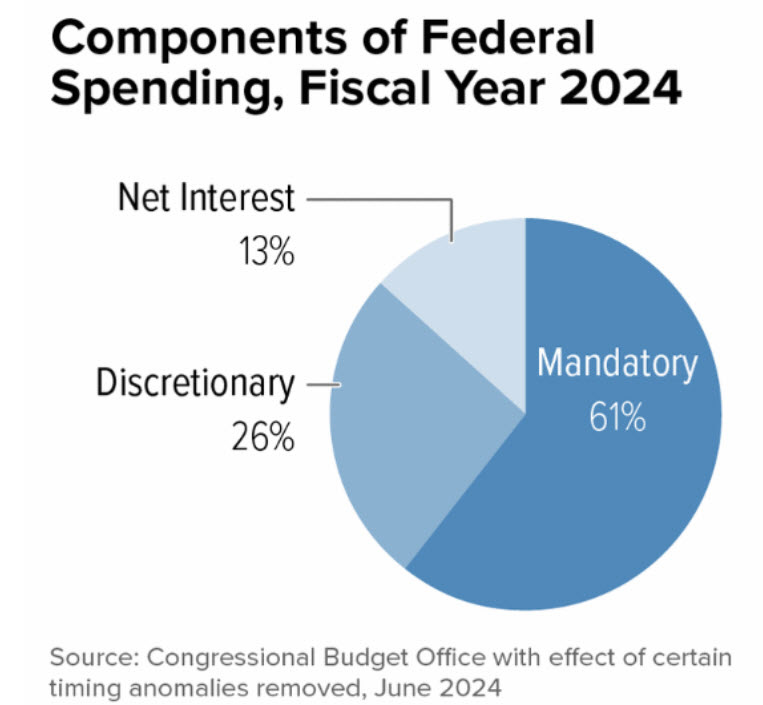

Now that's not nothing – but it's not even enough to cover the federal government's annual debt service costs. And it’s a best case scenario! It doesn’t account for retributive tariffs. What about DOGE – could Team Musk slash $2 trillion in government spending? I’m afraid the answer is no. Simply because the vast majority of government spending is non-discretionary – meaning it will happen regardless of what Congress does.

I mean, unless Elon Musk’s agents who are currently (somehow without security clearance, authorization or permission) elbows-deep in the top secret systems of the Bureau of the Fiscal Service’s payment software simply break something. I hope that doesn’t happen, but it’s certainly possible. So what does this really mean for you? Simply this: These books are not going to get balanced. The status quo of government spending without a thought about where the money comes from is gone forever. I conclude the next four years will inevitably see one or more of the following challenges:

This sounds grim, doesn’t it? That’s where we’re at, though. Like a family on the brink of declaring bankruptcy trying to decide whether to pay the electric bill or the mortgage (and whether cutting the kids’ weekly allowance to $0 would make a difference). The good news is that it’s not too late for you to prepare yourself to be able to weather the storm no matter when tax rates increase (and rest assured, a future administration will lack even the most basic understanding of economics and will increase taxes). What is that action? It is to build a solid foundation for your financial house by diversifying into stores of wealth that are resistant to inflation, manipulation of the money supply, and manipulation of the economy. In my opinion, the best option for that diversification, for a number of reasons, is precious metals, and we’re happy to provide information about that so that you can make the wisest investment choices for your personal financial plans.

|

Send this article to a friend:

|

|

|