Send this article to a friend:

February

13

2025

Send this article to a friend: February |

Gold Outlook: Murky For the Metal, Bright For the Miners

It’s another great day for gold, with $2,800 in the rearview mirror and $3,000 in traders’ crosshairs. This means it’s time to take a deep breath and consider gold’s — and the miners’ —near-term prospects. Reasons for Caution Let’s start with seasonality. Winter is usually a good time for gold, while spring and early summer tend to be boring and/or scary. March and June especially tend to be down months. (Thanks to Callum Thomas at Topdown Charts for some of the following charts).

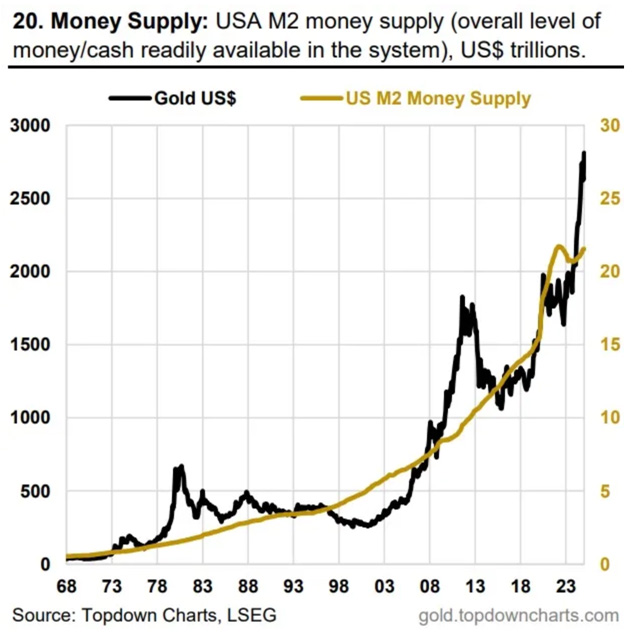

Gold also seems to have gotten a bit ahead of money supply growth…

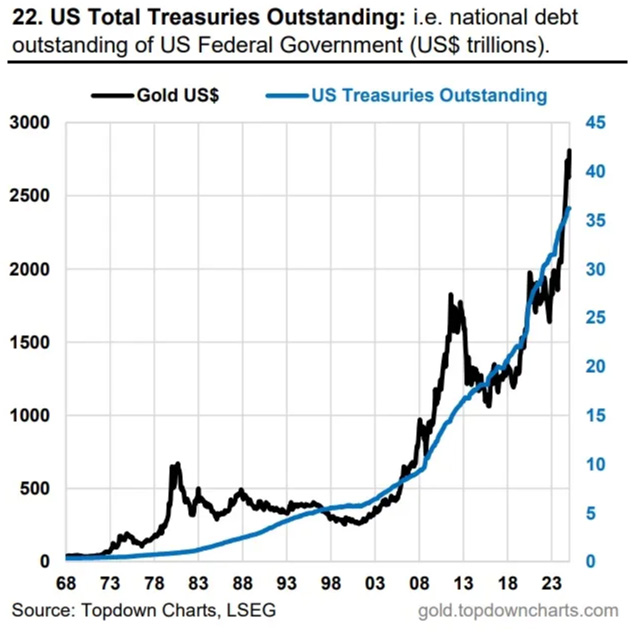

…and government debt:

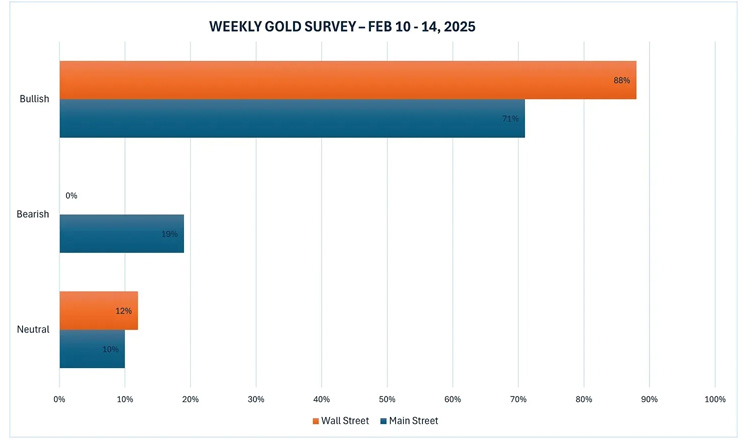

Almost everyone expects the rally to continue, which is generally a red flag. From Kitco:

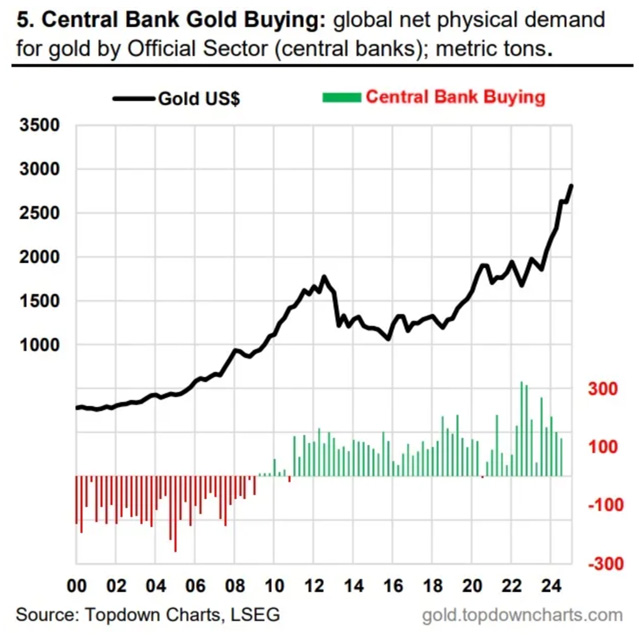

On the Positive Side Central banks don’t seem to be put off by a rising gold price and are still buying:

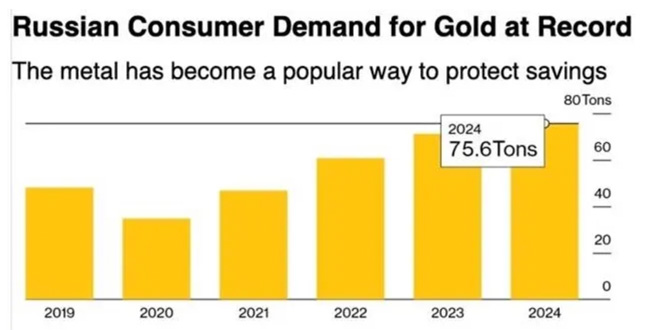

Russia has been especially aggressive lately:

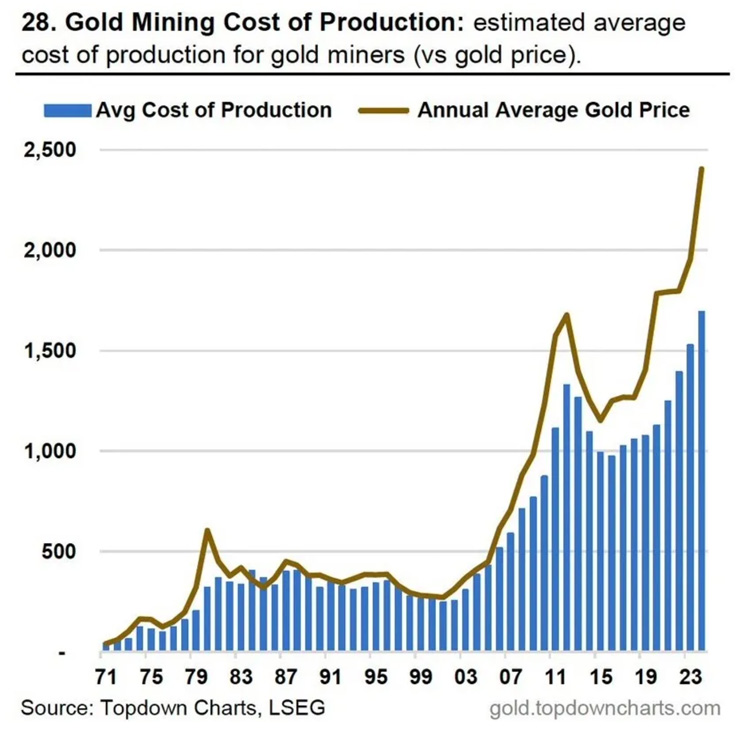

And — crucial for the mining stocks — gold seems to have finally outrun gold miner operating costs. Well-run miners are now earning $800 or so on each ounce sold, which should produce some positive earnings surprises. This might offset a lackluster gold price if seasonality wins out again.

Conclusion Now might be a good time to manage expectations. Continue to dollar cost average into physical metals and add to high-quality miner positions via low-ball bids and put writing. But don’t let FOMO (fear of missing out) cause you to overpay. I’ll track the earnings reports due out this month and will post updates every few days. Subscribe to John Rubino's SubstackThousands of paid subscribers Survive and Thrive in the Coming Crisis

|

Send this article to a friend:

|

|

|