Bond Market a Tad Antsy about Inflation Not Just Vanishing? One-Year Yield Nears 5%. Mortgage Rates Back at 6.5%

Wolf Richter

“The equity market is refusing to accept this reality”: Morgan Stanley. “The equity market is refusing to accept this reality”: Morgan Stanley.

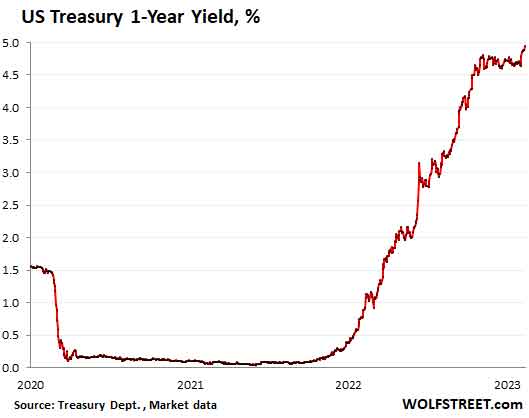

Since the close on February 2, which was the day after Powell had once again spoken about stubborn inflation in services and higher rates for longer, the one-year Treasury yield has jumped by 31 basis points as of this morning, to 4.95%, the highest since July 2007, and closing in on the magic 5% that seemed like a ridiculous pipedream – or nightmare, depending on where they stood – a year ago.

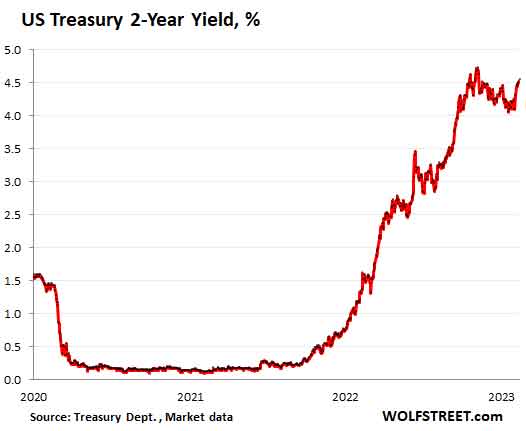

The two-year Treasury yield has jumped by 45 basis points since the close on February 1, which was Powell Day: to 4.54% as of this morning, reversing more than two-thirds of the 65-basis-point decline from the high on November 7 through February 2. That decline at the time had been driven by widespread Fed-pivot mongering, even as Fed officials themselves have said time after time, and as the Fed’s written projections released at the December meeting have pointed out: the Fed would push rates higher and keep them there for longer.

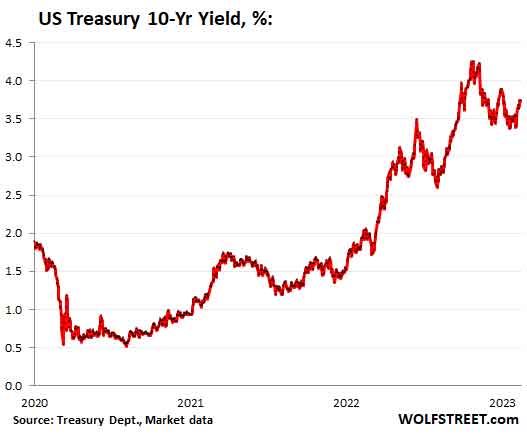

The 10-year Treasury yield has been a little slower to react, but it still rose by 34 basis points since the close on February 1, Powell Day, to 3.73% at the moment, after closing at 3.74% on Friday, having undone now a portion of the blistering January rally in prices (yields drop when bond prices rise):

All eyes are now on the CPI report to be released tomorrow. The Bureau of Labor Statistics on Friday revised higher the month-to-month CPI readings for October through December, showing that there was less “disinflation” in October and November, and worse “inflation” in December than the original month-to-month data had indicated. All of which took a big bite out of the “disinflation” hoopla.

It didn’t help that the jobs report for January explained in detail on February 3 what Powell had said earlier about the labor market, that it was still feeding into “core services inflation.”

In addition, the BLS made its annual revisions to its labor market data, including a big upward revision to nonfarm employment for the period through December 2022, showing that the labor market in 2022 had been even tighter than previously shown in the data.

Ironically, the stock market and the bond market would love to see a plunge in employment, and a surge in unemployment, that would “force” the Fed to cut rates – though stocks have a history of plunging once the Fed starts cutting rates.

The average 30-year fixed mortgage rate rose to 6.50% on Friday, according to Mortgage News Daily, having bounced by 51 basis points off the low of 5.99% on February 2. As of this moment, today’s daily mortgage-rate average hasn’t been released yet. The hopes of an average 30-year fixed mortgage rate in the 5%-range that were widely bandied about in January have now vanished.

Also vanished have the hopes for less volatility in mortgage rates. The wild ride is back, which makes selling homes a lot harder.

This comes after the bond market –and the stock market too – had spent all January blowing off whatever was going on, including the prospect of higher rates for longer and the earnings recession that has now started.

The stock market plays its own game. After jumping on Powell Day itself, which closed off the red-hot January, the S&P 500 has since then lost 2.1% through Friday at the close, amid crappy earnings, higher yields, and Google’s AI presentation that proved once again that AI is very good at producing logical-sounding BS, which knocked down Alphabet’s shares. AI had been the latest act of the Wall Street hype-and-hoopla show, and it degenerated into AI humor.

The S&P 500 is down 15% from its high on January 3, 2022. But it was down over 20%, and in January recovered by a bunch all the way through Powell Day. After which the rally sold off.

Not everyone on Wall Street sings from the same hype-and-hoopla page though. Morgan Stanley strategists, led by Michael Wilson, wrote in a note, reported by Bloomberg this morning:

“While the recent move higher in front-end rates is supportive of the notion that the Fed may remain restrictive for longer than appreciated, the equity market is refusing to accept this reality,” they said.

“Price is about as disconnected from reality as it’s been during this bear market,” they said.

“The risk-reward is as poor as it’s been at any time during this bear market,” they said.

“The reality for equities is that monetary policy remains in restrictive territory in the context of an earnings recession that has now begun in earnest,” they said.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Founder, Wolf Street Corp, publisher of WOLF STREET. Founder, Wolf Street Corp, publisher of WOLF STREET.

In his cynical, tongue-in-cheek manner, he muses on WOLF STREET about economic, business, and financial issues, Wall Street shenanigans, complex entanglements, and other things, debacles, and opportunities that catch his eye in the US, Europe, Japan, and occasionally China.

Wolf lives in San Francisco. He has over twenty years of C-level operations experience, including turnarounds and a VC-funded startup. He has a BA, MA, and MBA (UT at Austin).

In his prior life, he worked in Texas and Oklahoma, including a decade as General Manager and COO of a large Ford dealership and its subsidiaries. But one day, he quit and went to France for seven weeks to open himself up to new possibilities, which degenerated into a life-altering three-year journey across 100 countries on all continents, much of it overland, that almost swallowed him up.

wolfstreet.com

| ![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)