Send this article to a friend:

January

09

2024

Send this article to a friend: January |

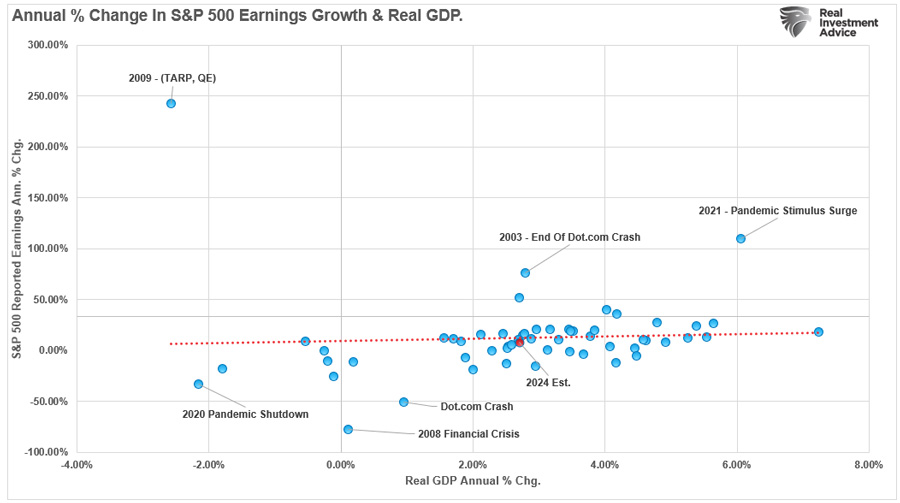

“Curb Your Enthusiasm” In 2025

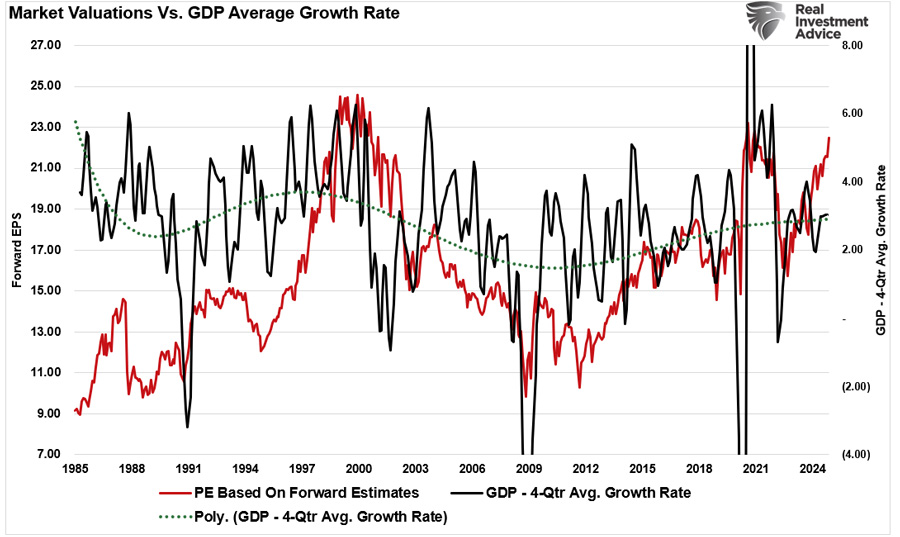

“Curb Your Enthusiasm,” which ran its series finale last year, starred Larry David as an over-the-top version of himself in a comedy series that showed how seemingly trivial details of day-to-day life can precipitate a catastrophic chain of events. The show never failed to deliver a laugh but also reminded me that unexpected events can derail the most certain of outcomes. As we enter 2025, the financial markets are optimistic. That optimism is fueled by strong market performance over the last two years and analyst’s projections for continued growth. However, as “Curb Your Enthusiasm” often demonstrates, even the best-laid plans can unravel when overlooked details come to light. Here are five reasons why a more cautious approach to investing might be warranted in 2025. 1. Valuations & Economic Growth RatesThe stock market starts 2025 at lofty valuation levels, much like Larry’s exaggerated monologues about trivial inconveniences. The S&P 500’s price-to-earnings (P/E) ratio currently sits well above its historical average, signaling investor exuberance. While valuations are a terrible market timing indicator and should never be used as such, they do tell us much about investor sentiment. As discussed previously, corporate earnings are derived from economic activity.

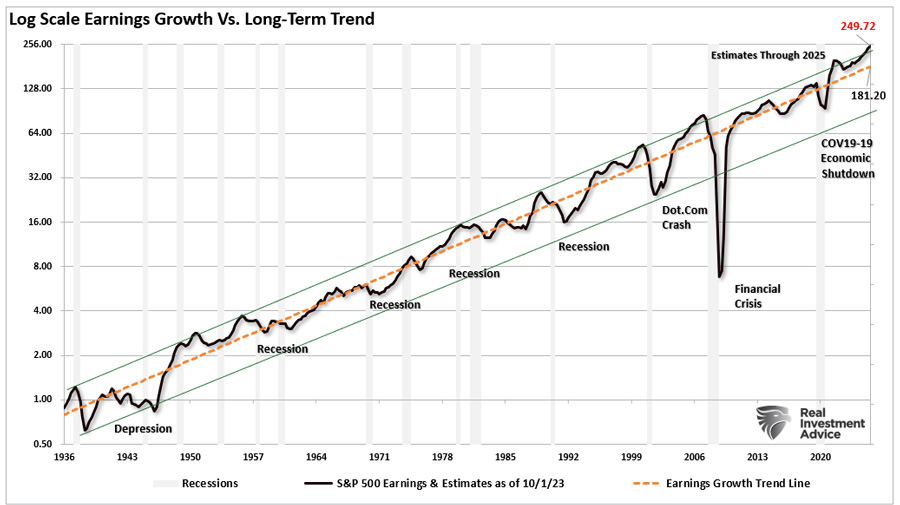

Current valuations suggest that stocks are priced for perfection as investors bid up asset prices ahead of what a declining economic growth rate can deliver. This leaves little room for error. In other words, investors are essentially betting on corporations’ flawless execution in a year when macroeconomic uncertainties loom large.

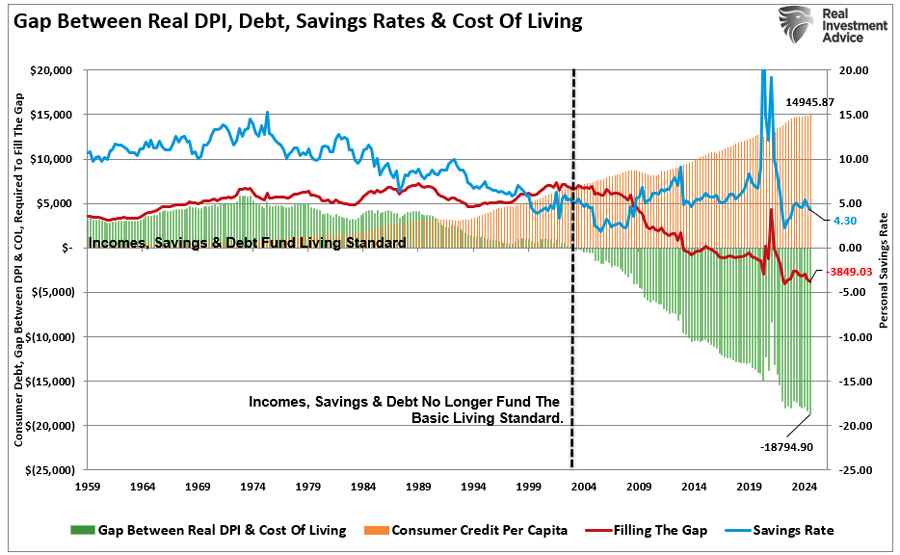

In 2024, the U.S. economy saw robust growth, driven by fiscal stimulus and a strong labor market. However, signs of a slowdown are emerging as we enter 2025. The Federal Reserve’s recent interest rate cuts may have provided short-term relief, but their effectiveness in sustaining long-term growth remains uncertain. Consumer spending, a critical driver of the economy, has shown signs of fatigue as households face diminishing savings and rising debt levels.

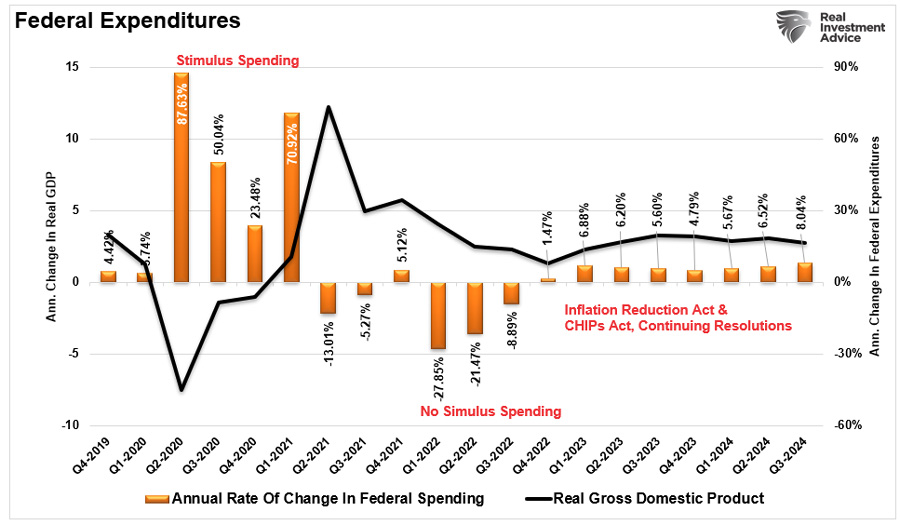

If economic growth slows in 2025, it could dampen corporate revenue, reduce investment activity, and impact stock prices. Much like a “Curb Your Enthusiasm” episode where things take an unexpected turn, the risk of weaker growth looms large, potentially catching overconfident investors off guard. 2. Fiscal Policy & Global Economic Growth RatesNo “Curb Your Enthusiasm” episode is complete without an unexpected subplot that complicates the main storyline. In 2025, fiscal and political policies and slowing global economic growth could be the market’s unwelcome subplot. Over the past two years, ongoing fiscal policy from the Inflation Reduction and CHIPs Acts and ongoing increases in federal spending through “continuing resolutions” have supported economic growth. However, in 2025, reductions in fiscal policy may become a headwind as previous spending bills are exhausted without new ones to take their place. Furthermore, reductions in government spending by the incoming Administration via the Department of Government Efficiency could provide an additional drag on economic growth.

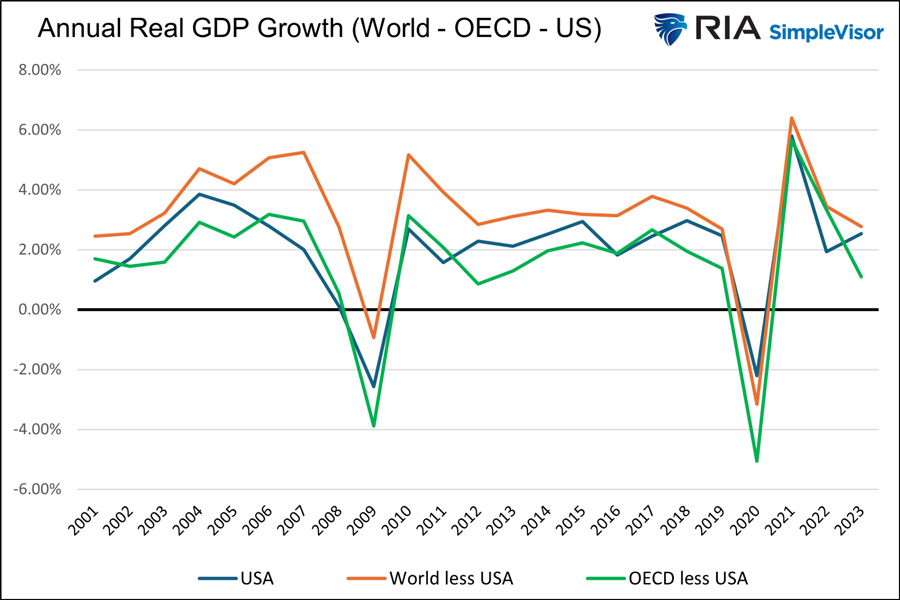

Additionally, the U.S. is not the only player in the global economy. Growth rates in key regions like Europe and China are slowing, adding another layer of uncertainty. Europe faces ongoing energy challenges and policy gridlock, while China’s economic rebound remains tepid amid property sector woes and shifting trade dynamics. As Michael Lebowitz addressed in “Global Conditions Portend To A Slowdown:”

While significant Federal deficit spending has boosted economic growth and offset higher borrowing costs and inflation, there are indications that support is slowing. Furthermore, the U.S. is not an “island of economic prosperity” but a global trade partner. As such, slowing global growth could dampen demand for U.S. exports, further pressuring corporate earnings, which, as discussed recently, remain exceptionally deviated from long-term growth trends and economic activity.

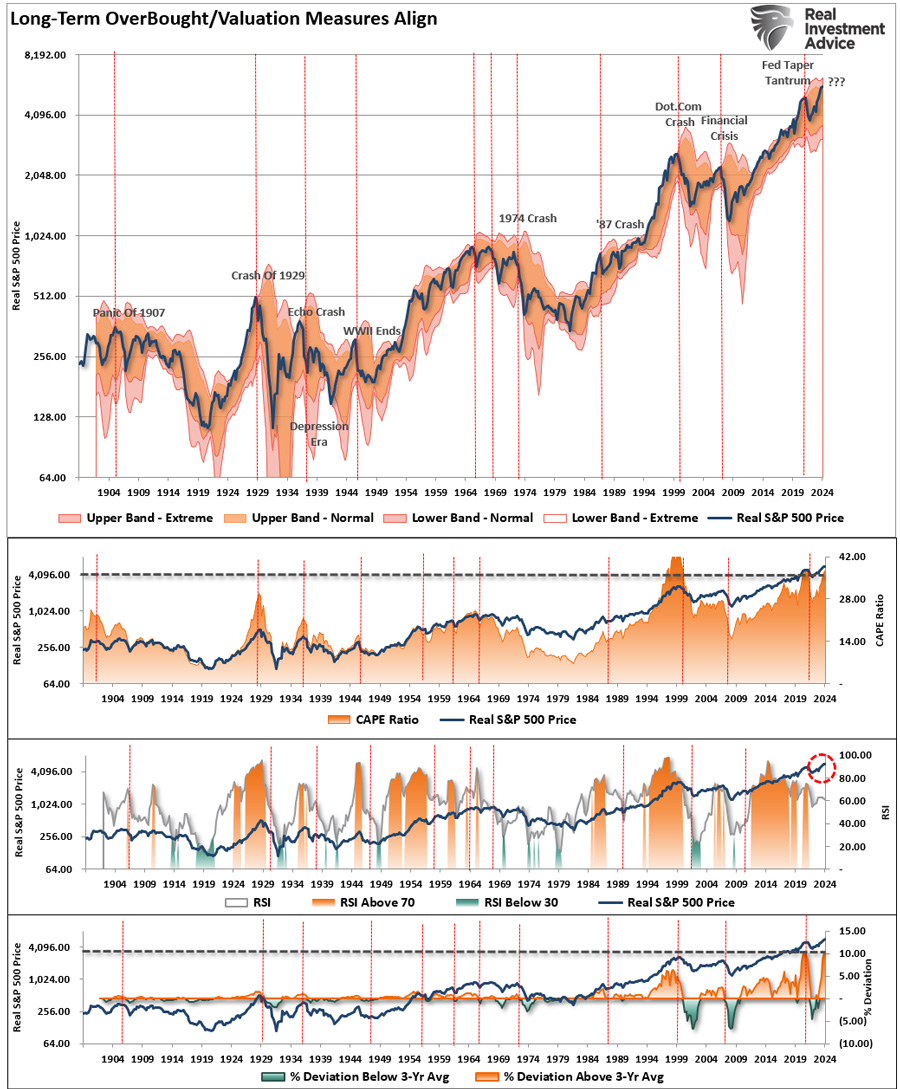

Much like a “Curb Your Enthusiasm” subplot that complicates the main story, weaker international growth could derail the optimistic narrative investors are currently embracing. 3. The Technical Backdrop The longer-term technical backdrop also provides reasons for “Curb Your Enthusiasm” in 2025. In September 2021, I produced the following chart stating:

Of course, just three months later, the market began a nine-month correction that clipped roughly 25% off asset prices before bottoming in October 2022. The chart has been updated through the end of 2024. It is worth noting that prices are again deviating from the long-term mean, valuations are extended, and relative strength is declining. Furthermore, investors are taking on increasing speculative risk and leverage, just as they were in 2021. Furthermore, expectations for corporate earnings, the lifeblood of market performance, appear overly ambitious. Analysts are projecting a nearly 20% increase in earnings for the year, a figure well above historical trends. However, these projections may not align with economic realities, particularly if consumer demand softens, the global economy slows further, or cost pressures persist.

In 2024, actual earnings growth fell short of forecasts, with much of the market’s performance driven by valuation expansion rather than fundamental earnings growth. If this pattern continues, the risk of a correction increases. With all “experts” currently expecting above-average economic growth and earnings rates in 2025, investors should consider “Curbing Your Enthusiasm.” As discussed in “Bob Farrell’s 10-Illustrated Rules:”

Such certainly seems a risk to consider heading into the new year. “Curb Your Enthusiasm” Doesn’t Mean Exiting the Market I am always reticent to discuss taking a more “risk-averse” approach to the markets. Such is because investors typically interpret such commentary as “sell everything and go to cash.” While 2025 presents its share of challenges, the solution is not to abandon the market altogether. Instead, investors can take practical steps to navigate these uncertainties. None of this means the next “bear market” is lurking. The data does suggest that being overly aggressive, taking excess risk, and increasing leverage may not have the desired outcome. Since exceedingly bullish markets are a function of psychology, they can last longer and go further than logic predicts. The requirement to “end” such a phase is an exogenous event that changes psychology from bullish to bearish. Such is when the stampede for the exits occurs, and prices can decline very quickly. As such, investors need guidelines to participate in the market advance. But, of course, the hard part is keeping those gains when corrections inevitably occur. As portfolio managers for our clients, this is precisely the approach we take.

Notice, nothing in there says, “Sell everything and go to cash.” Investing in 2025 will require a blend of optimism and caution. With slowing economic growth, fiscal policy uncertainties, global challenges, overconfident sentiment, and ambitious earnings expectations, investors have plenty of reasons to approach the markets carefully. There will be a time to raise significant cash levels. A good portfolio management strategy will ensure exposure decreases and cash levels rise when the selling begins. Taking advantage of bullish advances while they last is essential. Just don’t become overly complacent, believing, “This time is different.” It likely isn’t. Remember, as Larry David might say,

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.

|

Send this article to a friend:

|

|

|