THE DEEPER DIVE: Will the Stock Market Dive in '25?

David Haggith

My big economic prediction for 2025 is here! My big economic prediction for 2025 is here!

The stock market’s story for 2025 is going to be the story of the bond market. And the story of the bond market is going to be the story of inflation. It’s a continuation of the same old story I’ve been telling; but it’s more complicated this time. So, first—so you can fully grasp the predictable dynamics—the …

Backstory

Back in 2015, I wrote the Fed had boxed itself in to where it could not turn off its easy money without crashing things. I said then that the market would fall. (In the graph that follows, the prediction was made during the first small dip that proved to be, as I thought it would, a foreshock of the big quakes to come.) So, this is a dynamic I’ve pointed out for a long time, and it has always been right:

When all of this stimulus began, many people asked if the Fed had a way out at the end. Could it turn off the spigot of free-flowing money and not crash the economy that it had appeared to build back up? Now it looks like it cannot turn off the spigot. The Fed looks like it has boxed itself into a corner. Even its only end game of a very, VERY slow taper is not working. It is turning into relentless indecision and constant drag. The taper has become so long it is painful.

We saw the bull’s back break in a shocked response to Fed tapering that reverberated throughout 2015-2016, taking two big plunges and finally closing that period where it began. So, the market didn’t completely crash, but the bull lay half-dead on the ground for two full years! That’s big in itself. The Fed began tapering QE and then just slightly raising interest rates during that time—slightly—and the market got bounced around like a bull tied to the back of a freight train, but went nowhere:

MarketWatch with my annotations

In 2018, we saw that same dynamic again when the actual tightening via QT began, versus just tapering QE. This time I was so certain the market would crash that I bet my blog on it, promising to stop writing on economics forever if I was wrong in order to let people know how certain I was. One popular market prognosticator—a Harvard graduate with a double major in economics and some other Harvard specialty, who fancies himself brilliant on stocks—argued publicly with me that I was ignorant and had no idea what I was talking about—that the market does not respond to the Fed or the economy!

Yet, the stock market crashed in the exact manner I described back in 2017. I said it would hit in 2018, starting with a hard plunge in January that would be just a precursor to the crash, followed a period of lightening up with some summer trouble, and finally the big crash would hit in the final quarter of the year. It did all of that. It plunged when the Fed ramped up its tightening in January, then settled out. The summer trouble came in the form of all the FAANG stocks—the markets indomitable leaders at the time—breaking off and crashing into their own bear markets, starting in late spring for some and summer for others. Finally, it took the Russell 2000 down 20%, and the S&P within a fraction of that in the fall. (I hadn’t placed any percentage targets to define that crash, so my Harvard heckler cried fowl because not all indices had crashed and 20% barely constituted a bear market.)

Note that, even though QT began in the final quarter of 2017, I had been precise enough to say in my prediction that the start of QT would not trouble the market at all because it was so small and the market had been anticipating it, but that the series of events I was predicting would start in January. And that is exactly what we got. In fact, the market did a melt-up at the end of 2017:

Then, in 2019, we again saw this dynamic hit. Only, this time I said I did not expect the Fed’s tightening to hit stocks, which had already seen their action, but that it would very likely hit the repo market hard in the latter half of the year. I made that prediction because the Fed continued the tightening that closed 2018 with that minimum crash, by running QT and interest hikes for way too long beyond the crash. The stock market stopped crashing because the Fed made it clear it would be looking at shortening up its whole tightening agenda (QT and interest hikes), and the market anticipated the Fed would do as it said, releasing it from its panic over tightening.

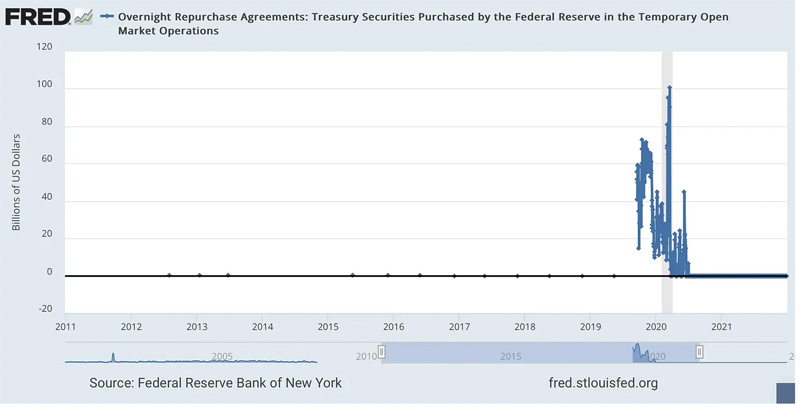

So, I wasn’t expecting more action in stocks; but, in January of 2019, I predicted that, by continuing as long as it planned to do with QT, the Fed would end us up in a repo crisis in the second half of the year because bank reserves would get too low by then. (Repo loans are where banks go to each other to get quick-and-cheap “overnight” loans to clear their daily transactions or, in the case of what is graphed below, run to the Fed for overnight loans when banks no longer trust each other or no longer have enough money in their reserves to make loans to other banks; i.e., when reserves dry up.)

This is what happened:

Fed graph showing the 2019 repo crisis

I couldn’t find a Fed graph for its interest rates on overnight loans. Perhaps that is because it is too ashamed to show the extraordinary moves in interest that happened in this normally deadpan market because of its tightening. What it does show, as my proxy for rates and an equal indicator of the scale of the repo problem, is the huge burst of activity in repo loans at the Fed.

Notice that, for years prior to that explosion out of nowhere, there are mere blips of activity spikes along the way—very, very tiny spikes from a rate that is otherwise so low, if it happens at all at the Fed, that it is invisible along the bottom line—prior to the hugely eruptive crisis. Then, in September of 2019, we got this enormous explosion in the normally sanguine repo market, which was when activity and interest rates hit levels heretofore unseen. It was a huge crisis, and it only ended when the massive Covidcrisis QE finally shoved reserves back up to where they moved out of trouble in 2020.

Yes, the Fed had to leap from QT right back to QE, and it wasn’t because of Covid, as you can see from where the trouble began; but Covid gave them cover to go back to QE without having to admit QT had not only not been “as boring as watching paint dry,” as gramma Yellen had assured us it would be, and could “continue on autopilot,” as J. Powell assured us it would; it was catastrophic.

The Covidcrash of 2020. Next, I predicted in February of 2020 that a crash was imminent because the market was so “precariously poised.” Then Covid hit, and governments forced business lockdowns around the world and terminated shipping, which all caused a massive crash. However, because that economic anomaly would have caused a massive stock crash, no matter what, we’ll never know if my prediction for 2020 would have been right without that anomaly. I won’t claim the win when it was Covid that killed the precarious stock market, but I certainly wasn’t wrong.

One thing I did predict correctly, though, that we did get to see was that I had already claimed, at least a year prior, that the Law of Diminishing Returns had caught up with the Fed so that its next QE would not save the economy or stocks. And it did not. Try as it might, and it tried mightily hard, the Fed could not arrest the market’s fall. So, it got the US Treasury to join in with it in the biggest expansion of QE ever and placed all that money directly into the coffers of businesses and citizens, going to the “helicopter money” the Fed had never tried before. And that joint effort finally worked. The market settled down, but that just proves how incredibly deep the market would have crashed down that steep waterfall if not for the biggest Government-Fed stimulus ever seen. The size of the necessary rescue clearly indicates the depth the fall would have reached.

The crash of 2022. (Get the feeling the Fed creates a lot of crashes in its more and more erratic cycles?) Months before any of this inflation began, I started predicting inflation was coming hot and quick and would take the market down again and take it down harder than in 2018. Few people saw it, including anyone in the Fed, while that Harvard graduate with a double major in economics and some other Harvard specialty, who fancies himself brilliant on stocks, told me there was no way inflation was coming, and he assured me he had the better credentials to know and that I was an idiot. Therefore, he said, there was also no way rising inflation would crash the stock market, aside from the fact that, in his opinion, inflation could not do that even if it did show up.

So, I bet my blog again, but he wasn’t brave enough to put anything on the table if he turned out to be the one who was wrong (of course, because tough talk is cheap). I was certain enough, however; and I didn’t care that he placed no wager because I was betting my blog to show my conviction, not to win easy money.

It went exactly as forecast. That all went down like this:

In October of 2021, I wrote—before any stock-market action to the downside—the following summary of my consistent predictions throughout that year:

My claim for the past year has been that inflation will rise so high and so long that eventually it will kill the stock market bull (i.e., will cause, at minimum, a 20% crash into a bear market, though I think it will eventually be down by more than that). It will do this one of two ways by impacting investor sentiment because it forces the Fed to tighten sooner and harder (as we’re starting to see), or it will kill the stock market bull by killing the economy all around it with crushing cost increases (as we are also seeing).

The market crashed throughout 2022, right from the first day for the S&P, and Wikipedia summed the crash up this way:

The 2022 stock market decline was a bear market that included the decline of several stock market indices worldwide between January and October 2022. The decline was due to the highest inflation readings as part of the 2021-2023 inflation surge and the resulting increases in interest rates, combined with fears of a global recession due to a decline in economic indicators and an inverted yield curve, exacerbated by supply chain disruptions due to the 2022 Russian invasion of Ukraine

The Fed did wind up having to tighten sooner than it had been telegraphing, as I had claimed we would see, (though clearly far too late to do any good) and much harder than it had led anyone to believe, just as I had warned; and it was throughout that intense tightening period that stocks crashed down a series of seemingly endless chutes. They couldn’t withstand it. So much for Harvard Man’s pedigree.

That looked like this:

That is why I wrote in January of that year, right at the start of what turned into nearly a year-long crash:

The Fed has trapped itself in an inferno.

Inflation WILL kill this stock market bull….

The Fed's LOVE of zero rates for an entire decade and massive money printing have laid in a huge supply of money fuel to burn. It's not just a tinder box; its is an entire house of cards filled with tinder, soaked in fuel. The Fed has boxed itself into this inflation trap by laying in all the tinder and fuel necessary to keep inflation burning hot for some time, which will force it to attempt to suck the fuel back out very quickly—far quicker … than we have ever seen before…. This is going to be far more unsettling than previous rounds of Fed tightening….

That trap, I even noted, was why I was certain clear back in late 2020 and all through 2021 the Fed would stay with low interest and massive money printing too long and run inflation quite hot before it got on the program of trying to lower it. The Fed kept hoping inflation was transitory so they could avoid crashing their rigged economy and markets because, when the rigging goes, the markets go.

And here is the somewhat more philosophical summary I gave back in January of 2022 for what was coming throughout the year: (all on The Great Recession Blog before writing here. I’ve reposted the articles here now so they can be referenced as I did above, and that is why the formatting is a bit screwy. With hundreds and hundreds of articles, I wasn’t going to reformat them and rebuild links just so I could reference them after I let my other site go down to save money and focus on Substack.)

Now inflation is a raging inferno the Fed cannot easily put out, so the Fed has switched to a tightening regime, which will have to become quantitative tightening (where the Fed actually sucks money out of the monetary system) in order to wrest inflation under control. Interest-rate increases throttle money supply by reducing the velocity of money, but they don’t necessarily reduce the money supply. At least, not directly. While they curb inflation, we will need to see overabundant money supply dwindle in order to stop high inflation. There is just way too much liquid fuel in the system.

Of course, the stock market is going to lend the Fed a hand there by becoming the new money incinerator to burn that fuel off as money that only existed in computer accounts gets written down rapidly. Think of that as the "flash" tower in a refinery that rapidly burns off fuel when there is trouble in the system. What was mistakenly thought of as wealth is going up in curls of fire and smoke as I write. (I say mistakenly because this phantom wealth was all built on debt, making for easy stock buybacks and easy dividends, not on actual fundamental productivity and profits and capital investment for a more productive future. I am not saying there was no productivity or profits, but I am saying those are NOT what was paying for all those massive stock buybacks over the past decade that pushed up stock prices into bubblicious heights.) Easy come, easy go.

I also laid out back then, contrary to Janet Yellen’s comment covered in The Daily Doomearlier this week, the cause of this soaring inflation:

The longer the Fed delays its tapering, the more inflation will [damage the economy]. The Fed easing, instead of helping the economy at this point is killing it with kindness, making it easier for workers to stay away and easier for everyone to bid prices up on short supplies. The days when the Fed can help with loose money have finally reached their natural end.

All fitting Wikipedia’s later summary of the event. Many times I had written earlier, in the summer of 2020, that the lockdowns were going to create huge supply shortages and that the Fed’s money printing with the help of the US Treasury were going to feed into those shortages to bring about soaring inflation in 2021. The entire time I wrote that, the Fed kept saying it saw no inflation coming. When it did start to come in 2021 as I expected it would, the Fed kept saying it was “transitory.”

Here was my reason for betting my blog on a stock crash this second time, as I noted after the bet was won:

I predict these things to warn people, and if I sounded the alarm as often and loudly as I did last year and proved dead wrong, I would be a detriment to people. I would have honored my bet and packed it in just to avoid being a false alarm on predictions as massive as the one I was making, especially given that it was so different from what almost every analyst and bank and the Fed, itself, was saying. I made the bet and repeated it often in order to make it abundantly easy for any critic to hold me to my word.

Twice, I’ve been certain enough to make that bet regarding the impact on stocks, and I’m still here. Both times the same arrogant Harvard blockhead loudly accosted me in his own writings for my foolishness, and both times the market crashed.

In December of 2021, when the crash hadn’t yet begun in the S&P, I wrote again about my second bet to explain some of the dynamics in one of my Patron Posts for paying readers (forerunner to my Deeper Dives). I said that the Fed, by stopping its bond purchases and changing its interest targets, would cause a wave to go through the bond market that would take down stocks as bond’s repriced once the Fed’s fat hand was lifted off the scale:

This unraveling of bond price distortion and the markets it will impact is , of course, the theme I wrote about in my last two Patron Posts, one of which I will soon be making generally available to other readers because I want everyone to be able to understand what is about to happen all around them in the early months of 2022. You, however, got to hear it well ahead of the pack….

Bond repricing, as the Fed lets its grip slip as it shifts to no longer being the buyer of first resort, will massively impact all financial markets. Patrons were able to realize that first in a series of articles that revealed how inflation would push the Fed out of its QE bond buying at a rapid pace and pressure it to stay out and why that would result in bonds repricing, so you have had more time to consider your preparations. Now, inflation has risen to the point I was forecasting where its forces have clearly captured the Fed's full attention to such a point that the Fed admitted to the entire world it was wrong about inflation and to where inflation is now high enough to rip into the economy, too. The Fed has already been forced to taper faster at a time when the economy is already deteriorating in stagflation. The Fed couldn't ask for a worse scenario.

Similar dynamics in bonds are now in play. However, this time it is not because the Fed is tightening, but in spite of the fact that the Fed is loosening, which indicates the Fed has lost control. That is different than all of those crashes I predicted, and that makes this situation trickier to predict because my last predictions were based on the cause-and-effect of Fed policy, but bonds are now blazing a trail of their own, independent of what the Fed does.

I’ll lay out below how I think that plays out this time with my predictions on how the stock market will respond, even though the reverse action is happening from the Fed as it, so far, continues to lower rates. You may wonder how on earth the Fed creates so many predictable cycles of economic and stock crashes. The answer to that was the basis for my humorous little book about those cycles, written after the Fed created the first housing bubble that busted into the Great Recession: DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles. It is because the patterns laid out in the book are as predictable as the book said that I can keep predicting the outcome of each turn in the Fed’s cycles.

Share

And, now, for paying subscribers, here is how this is going to play out in this cycle:

Keep reading with a 7-day free trial

Subscribe to The Daily Doom to keep reading this post and get 7 days of free access to the full post archives.

Economic, Social and Political News of Our Troubled Times -- a non-partisan daily collection of the most consequential stories about our complex times from multiple sources around the world.

www.thedailydom.com

|