Send this article to a friend:

January

16

2023

Send this article to a friend: January |

A Long Way to Fall: Stock Market’s Bottom is Hardly Even Within Sight

Even if you don’t have money in stocks, you might want to listen. The destruction of trillions of dollars of wealth in the world as the Fed hoses up all the money-slop is changing the world and will continue to do so. So, before you go bargain-scooping for those fire-sale stocks, consider the predictions in this article by market gurus that have finally started sounding a little like yours truly with my predictions of the coming Epocalypse (though they are not quite that crazy yet): The Daily Doom, during just the first two days of this week, covered a few surprising voices in its headlines that brought forth this message, which I’ll summarize for you in the article that follows:

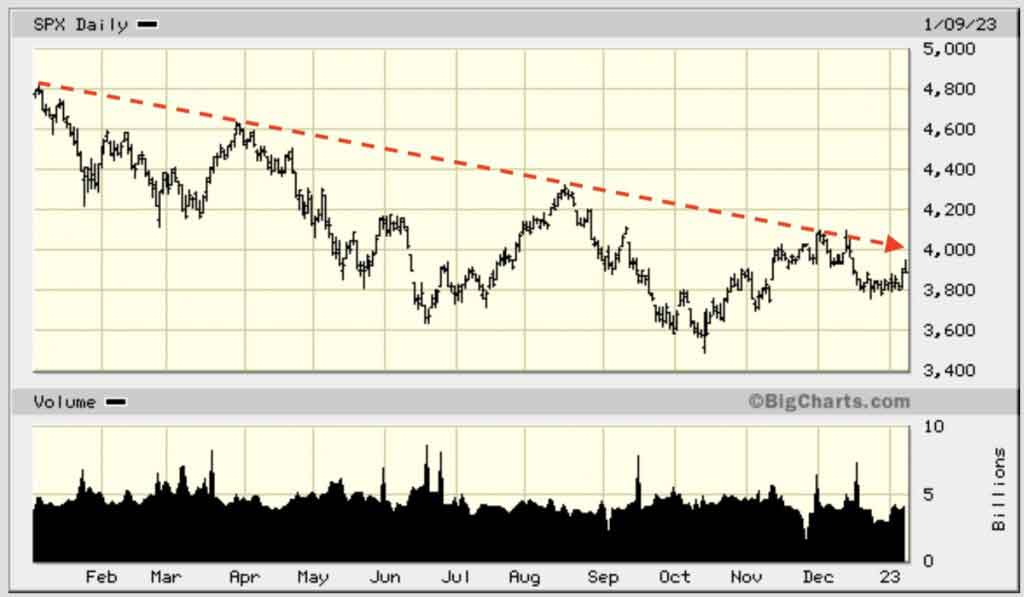

… and in tomorrow’s edition … one more: The two-Michael’s madness I’m not criticizing them. They simply now share my madness, having come into their predictions a few months after I started anticipating this journey back in the summer of 2021. The strongest of these voices is Michael Wilson of Morgan Stanley. While I did criticize Zero Hedge for making so much of the “Two Michaels'” predictions when Michael Wilson and Michael Hartnett of BofA predicted a huge rally for November-January, the market did manage to pound out another perfectly typical bear market rally. That fizzled out at the size of earlier rallies and didn’t as long as the Michaels made it sound, but it is now meagerly attempting to reclaim that height in first part of January, which Wilson had said would still be good for the market up to about January 15, if I recall what he wrote almost three months ago:  This time, the stock market didn’t return to the bottom of its year-long, bear-market channel because Santa Clause, who failed to deliver an actual rally at the end of 2022, did, at least, clip the bottom off the market’s mid-December slip in the snow to where the market slid sideways on its butt through the remainder of December. Now delusional market investors are trying their best to be market makers and drive the market up in their re-inflated hope that a new year may be one of better news and somehow magically wipe away the mess of the last two years. Not so, says Wilson, who is the only voice from big banks that has been right for an entire year in his bearish cast (as Hartnet joined him a couple of months in). No, the worst fall is yet to come. Wilson predicts another 22% avalanche right up ahead, even though the S&P already managed to finish last year at a 19% recess, leaving it sitting right back at the threshold of that 20% drop-off that put it in this unabating bear market. So, no matter what the market does in the weeks ahead, if you don’t believe me, you might want to pay attention to Wilson who has seen things generally the same way I have all of last year, and who has a lot of math to back his predictions up:

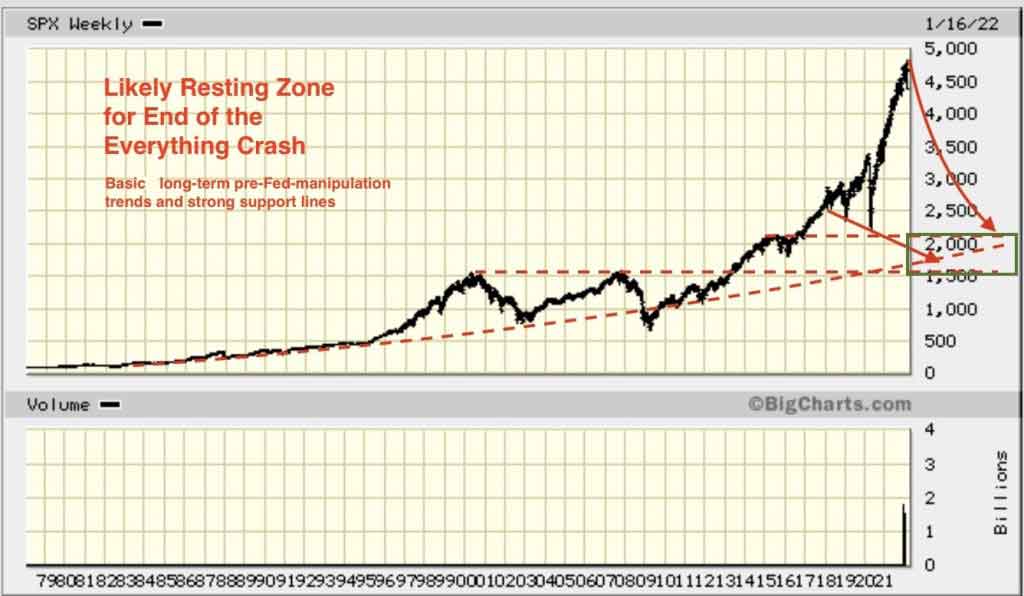

Wilson, for his score of successes all of last year, was ranked #1 in an institutional survey. If he continues to be as right in his trajectory predictions this year as he was all of last year, the market will be approaching the zone (dollar-green box) and glide path I predicted in a Patron Post last January this market would get to:  I’ll note that, while Wilson was right in each of the steps last year the market took, he revised his ultimate bottom for the year as he went along. However, he did, at least keep revising down ahead of the markets moves. So, if you followed him, you would have done well in staying out of harm’s way and catching some rallies along the way. I laid out several paragraphs of explanation for the lines in my chart to my Patrons, and then explained this was not going to be short ride in getting there:

Of course, the market fell more and more from the time I wrote that in January, but the delusional investors that refused to believe in the Big Bear scenario that seemed so apparent to me kept buying the dip all the way down all of last year. So, January did, indeed, turn out to be the top for the S&P and the Dow. Those who were standing where the guy in this photo at the top of the article would have done well not to take the trip over the edge from that cornice on the all-time-spectacular blow-off-top: But, you know, do as you want. Some people love to ski avalanches, and some of them even live. Depends on the size of the avalanche and the skill of the skier, but this bear has been one of the big ones, and it still has lots of room to roll, and now even the market’s biggest enthusiasts are saying it, not just bearish Wilson (who is far from a permabear). That January summit, of course, was just the beginning of this big bear market for the S&P and Dow. I was merely pointing out we had passed the first mile marker in the Russell 2000 and almost in the NASDAQ to where the other major indices, which were just starting to crack, would be joining the avalanche for the rest of its trip down the mountain. The view from on top Clear back then, I pointed out that the problem for the dips who were buying the dips is that they didn’t believe the Fed. From the start of the year, I explained on a number of sites, especially in the comments on ZH, that the pivot mania was hoping for a pivot that would never come:

Why did I believe so fervently the Fed was not going to come to rescue this time when it had so many times before? Did I have a crystal ball? Of course not, just a little historic perspective that many of today’s market buyers don’t have:

My Patrons started the year with that knowledge, and this year they will be starting with additional predictions that I’ll eventually share with everyone far down the road, as I am with last January’s now. As they are materializing, I want everyone to get some perspective and understanding of where we are heading, which always means understanding where we came from, and what better way to do that than by going back to the view from the top last January? The always too-quick-to-criticize will jump to say, “But we never hit that green box in your graph;” however, the ride is far from finished. As I explained then, the crash into the green box was not going to be something that would be accomplished in 2022. Nor was the green box what I would quite call a prediction but more of a statement back the of where I think this is ultimately likely to go:

I, then, laid out a graph showing the pattern of the NASDAQ’s long crash during the infamous dot-com bust and explained why a similar avalanche to today’s was just getting going back in 2000 with lots of pretty pictures of mountain avalanches and cornices begging to fall for effect like this one:

That is a picture of where I believed the S&P stood at the start of January. How much more of a “blow-off top” do you need before the market cracks off and turns into one of these as it races to find the bottom:

The sure did. Many bet up on the market all the way down. The graphs I presented showed how the NASDAQ’s crash back in the big dot-com bust took twenty-nine months to find its bottom: (Note the graph I found has a typo and says 19 months, but you can count them along the bottom.)

Where are we on that graph right now? I would say today we’re standing on that small rise right after point #3, which was the one-year point for the NASDAQ back then. We’re ready for the next big plunge, which will include more rises and drops to come after this just as it did back then. The NASDAQ worked its ways down another 55% drop to its final resting point where it was ended up 78% below its summit. I’m not saying we will take that much over the year ahead, but you can see these big crashes can easily take two years or more to find their bottom; and, while the next part of the journey may have another very steep plunge in store when the market finally wakes up to reality, the journey becomes more stretched out because 55% (or 22% or whatever) from the present point is not as many feet of total altitude to fall in the same amount of time as that same percentage from the much higher summit. Now a chorus of strong voices has joined me I believed in this crash strongly enough that I bet my blog in 2021 that the stock market would enter a bear market by 2022. As you see, the blog is still here:

I admitted I had my errors in the past, which is no surprise for anyone, but gave this caveat:

Well, this time the Fed isn’t coming to the rescue. Those investors who were standing at the top of the cornice last January and decided to jump into the dip and buy found that out all of last year because this time really was different. In all the previous times where the Fed massively intervened in each big fall that I had said would happen, the massive scale of the intervention (at least, in my view) proved how bad the fall would have been without the intervention (and the fall was still bad, regardless); but this time the Fed can’t intervene. There is no safety net here until the economy breaks or inflation is put to rest, and my latest Patron post laid out what that is not likely to be soon. It is no longer just the Two Michaels who are saying this. Other market leaders are joining them quickly now to say the delusional market is not pricing in the true risk because investors continue to believe the Fed will pivot, which these advisors all say is not about to happen because inflation is not nearly close enough to dead. Let me close with a summary of quotes from the articles referenced at the start of this one about the plunge that even the big market-makers are now predicting, starting with Wilson:

If you want some of the granular detail of how Wilson comes to his point of view from market fundamentals, I’ll let you refer to ZH’s article; but for my summary view BlackRock’s Fink and others in the high world of finance agree for the same reason Wilson lays out:

Uh huh. Just like a year ago. They learned nothing from their first fall, so many will take the rest of the ride.

In the summer of 2021, I claimed inflation would be the big story for 2022, and now in 2023 it is still driving the story:

I also started saying worker shortages were key further back in this mess than I can keep straight, and I am still saying they are the Fed’s major blind spot and will lead the Fed to overcorrect into an even more cataclysmic recession. (See my last article: “It’s Worse Than it Looks: Beneath the Surface the Bottom is Falling Out, and People are Jumping out of Windows.”) These are the dangerous forces playing out: Inflation is forcing the Fed to keep tightening, which takes the guard rails off for the market because there will be no rescue. A sick jobs market is not simply raising the cost of labor as the Leroux is thinking about, but also reducing production and services to make all shortages worse, which could drive inflation counter-intuitively higher down the road if the Fed crushes production more, making shortages even worse in its misunderstanding of the jobs market.

How many times do Fed officials have to say it? Yet, the delusional market, even after a year of financial pounding, refuses to get this message. Regardless of the market’s delusions, the reality of our economic troubles is far from over; the fight by most central banks against inflation is far from over, even if it becomes a little less intense; so plenty more pounding from reality is coming.

Jamie Dimon, the well-named head of JPMorgan Chase, somewhat agrees, too:

Dimon, who pulled the plug that triggered the Repo Crisis in 2019 when JPM stopped loaning to other financial institutions from its withering reserves during the Fed’s last quantitative tightening efforts, noted that the effects of quantitative tightening remain a concern of his this time around. As you may recall, JPM gave no public warning before it pulled the plug last time. In fact, it took a few days of digging to figure out what suddenly tripped the market to fall. JPM just got to the point where it had enough and pulled repos away from clearing-house markets and hedge funds. Banks are prepping for worse times to come, not better Banks are gearing up for a recession as we start the year, which they were not doing going into the Repo Crisis, so they may become even less willing later this year to loan out from reserves as those tighten more because, even if the Fed stops raising rates, it hasn’t breathed a word about discontinuing the roll-off of its balance sheet, known as quantitative tightening, which tightens bank reserves. That continues at a faster schedule than the Fed set before the Repo Crisis.

That may not be a huge sum for six major banks combined, but it shows the move of retaining bank reserves is getting started. It’s that crack in the cornice of banking.

The job losses noted in that article, too, have barely begun; but that is why this is the start of that next run down from point #3 on the graph above in terms of gauging where we likely are in this collapse process, which I believe will ultimately be worse than the dot-com bust or the Great Recession because this is the collapse of the Everything Bubble — bigger bubbles and more of them popping all around the world, not just in the US. Into the abyss This is happening during a time of our first European war with Russia since World War II, massive global sanctions, scorching worldwide inflation, a badly damaged labor force around the world due to a continuing global pandemic that may be worse than the Spanish Flu, global economic lockdowns that we’ve never seen before, which come and go like bad weather … oh, and more than the usual amount of bad weather from an extreme global drought going right into massive coastal flooding as was also reported in The Daily Doom with links to stories and numerous photos and videos:

Do you think, with all of that, the reality that has spread across this earth in the past two years doesn’t have more punishment to deliver to this delirious stock market? It needs to get a grip. For the ride to come.

Good luck with that!

Good luck with that, too! Every time I said the stock market is going to go down more, the majority of writers I’ve corresponded with have said I’m wrong, and a small minority of my readers tell me the same; but I can only say what I believe, and I see no way the market is going to rise through that boiling mess as all the bubbles that the central banks of the world inflated are now busting in a world that seems plagued with more than the usual share of major problems and when politics have never been more acrimonious (at least, in my lifetime), even within parties, as well as the Fed crushing down on a work force that is already crippled because it never recovered to the size it was before Covid, and so its underproduction is likely a bigger pressure on inflation than those wage hikes the diminished workforce is requiring if its going to keep doing the job of caring a larger share of the load on the backs of fewer people. Our central banks and leaders don’t even begin to understand the problems within the labor market, let alone all these other things these same leaders make worse with lockdowns, vaccine mandates that strip away scarce laborers, continuing tariffs, and, yes, sanctions on top of it all; and they are too busy in internecine battles within their parties and investigations of the other party to ever spend time on solving the problems IF they even knew how to do anything other than compound them with their misguided ideas. In normal times, you could write much of that off as cynicism, but it’s hard to deny now if you look at all the historic dysfunction in the US government I’ve been covering in the news section of this site and similar dysfunction in Brazil and you weigh in the fact that the Fed is still trying to create a recession when we are already technically in one that we are simply denying. Our leaders are blind and dysfunctional and at war with each other. And the stock market? Well, investors are flying around like drunken birds inside of a falling cage.

|

Send this article to a friend:

|

|

|